Australia’s offshore wind industry; from zephyr to gale

Published Date : 2023-January-12, Thursday

Almost two years ago AltEnergy issued a warning that

Australia was being left behind in the offshore wind stakes. With two more

international renewable energy developers entering the Australian offshore wind

space this week alone, it now seems appropriate to declare a boom in this

country.

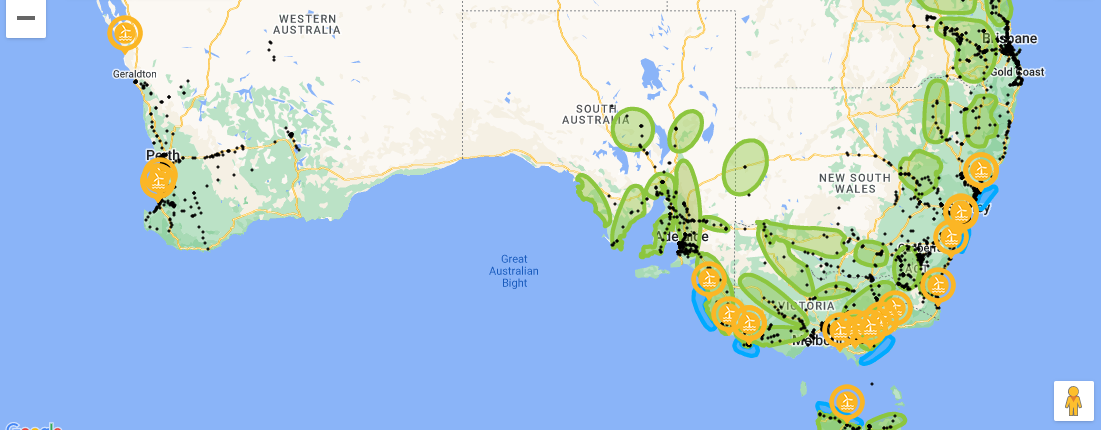

DP Energy has selected Australia for its first venture into offshore wind in the southern hemisphere. The Ireland-headquartered developer has begun development and feasibility works in five proposed areas which could potentially lead to a commercial licence. These areas are off the coast of Warrnambool in Western Victoria, Wonthaggi and Port Albert in the Gippsland Region, and Wollongong and Newcastle areas in NSW (see map below).

Onshore in Australia, DP Energy has developed projects such

as the 320 MW Port Augusta Renewable Energy Park in South Australia and the 430

MW Callide Wind Farm in Queensland.

Internationally DP Energy is pursuing offshore wind projects across Europe and Canada, including partnering with Iberdrola to deliver 3 GW of offshore wind in Ireland and EDF Renewables for 1 GW of offshore wind in the UK Celtic Sea.

The other company to this week announce its Australian offshore wind intentions is RES, who are also well known to the Australian large-scale renewable energy industry.

RES said it was “advancing offshore wind developments in Gippsland and further projects off the coast of Australia” and is progressing preliminary technical and ecological studies before starting “extensive consultation with the local communities”.

Describing itself as the world’s largest independent renewable energy company and a pioneer of the offshore wind industry, RES has supported the development of over 2.2 GW of offshore projects in Europe. Its portfolio includes significant projects such as East Anglia One, St Brieuc, Lynn and Inner Dowsing, Racebank and Lincs.

RES Australia has a large pipeline of around 20 onshore wind, solar and battery projects in development across eastern Australia representing a potential 3300 MW of total capacity.

So what has changed in 12 months in terms of attracting offshore wind development expertise to Australia? DP Energy explicitly referenced “greater government focus on the technology, backed by more supportive policy settings” at state and federal government level as a reason for entering this market.

AltEnergy (www.altenergy.com.au) is tracking 21 offshore wind projects in Australia and one in New Zealand (see map). That is excluding DP Energy and RES and others that are not so defined in terms of a specific project are or capacity.