Brookfield moves to 100% ownership of X-ELIO

Published Date : 2023-March-21, Tuesday

Global investment firm Brookfield has increased its

involvement in the Australian energy industry by acquiring 100% of Spanish

renewable energy business X-ELIO, which has several assets in Australia.

50-50 partner KKR agreed to sell its interest in X-ELIO,

acquired in a joint venture agreement with Brookfield in 2019, to Brookfield

Renewable.

Founded in 2005, X-ELIO is involved in the development,

construction, financing and operation of solar PV plants, storage and hydrogen

projects around the world, and is on track to build or develop 3 GW of

renewables projects in total across Spain, Italy, the U.S., Australia, Japan

and Latin America by the end of this year.

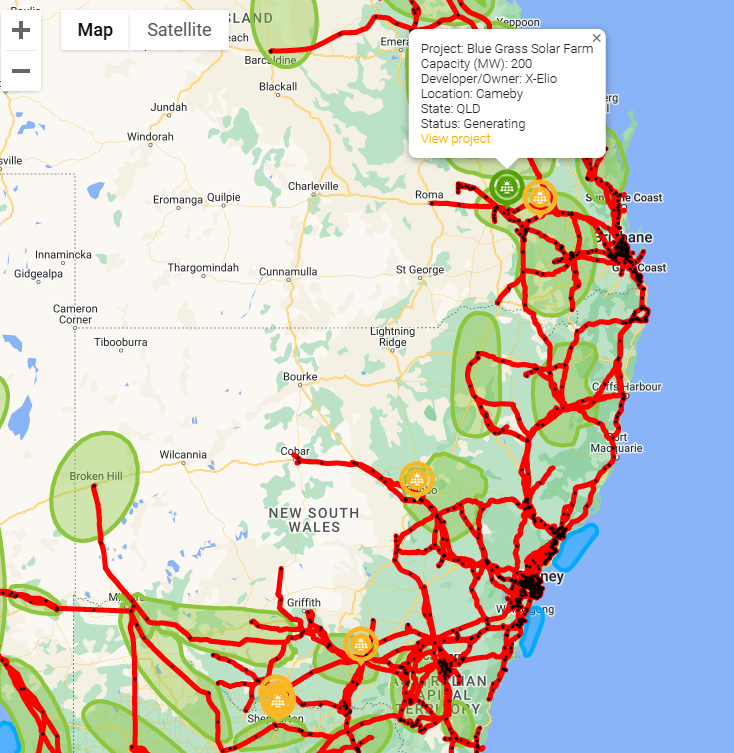

In Australia X-ELIO owns the recently completed 200 MW Blue

Grass Solar Farm in Queensland, and a number of solar farm projects in

development at Tallygaroopna (30 MW), Congupna (68 MW), Wunghnu (96 MW) in

Victoria, Jimbour East (200 MW) in Queensland, and Forest Glen (90 MW) and

Holbrook (300 MW) in NSW.

X-ELIO CEO Lluis Noguera said, “X-ELIO’s journey to become a

leading developer with diversified global presence would not have been possible

without our shareholders’ focus on execution and long-term value creation. Now,

with the continued support from Brookfield, we are in an optimal position to

continue growing our solar and storage business while tackling new

opportunities in the energy transition space”.

The transaction is subject to customary closing conditions

and is expected to close during the second half of 2023.

Full ownership of X-ELIO will see Brookfield increase its

position in the Australian energy industry. The global investment firm has made

an offer to purchase ASX-listed Origin Energy’s energy markets business,

Australia’s largest integrated generation and retail company, in a consortium

with EIG-controlled MidOcean Energy which would acquire Origin’s integrated gas

division.

Announcing the bid in November last year, Brookfield

Renewable said the deal was consistent with its “strategy of investing in opportunities

where we can generate a meaningful contribution to the energy transition,

including the responsible decommissioning of existing thermal assets and build

out new clean generation for the benefit of all stakeholders”.

On 22 February the consortium made a revised offer of $8.90 per share which the Origin Energy board conditionally supported pending further negotiations.

Brookfield also last year made an unsuccessful tilt at

ASX-listed AGL Energy in partnership with Mike Cannon-Brookes’ investment vehicle

Grok.