Strange winds blowing at Nullagine

Published Date: 2026-March-6, Friday

Fortescue subsidiary Pilbara Energy (Generation) Pty Ltd is

seeking approval for its Bonney Downs Wind Farm at

Nullagine, in WA’s Pilbara region, . . .

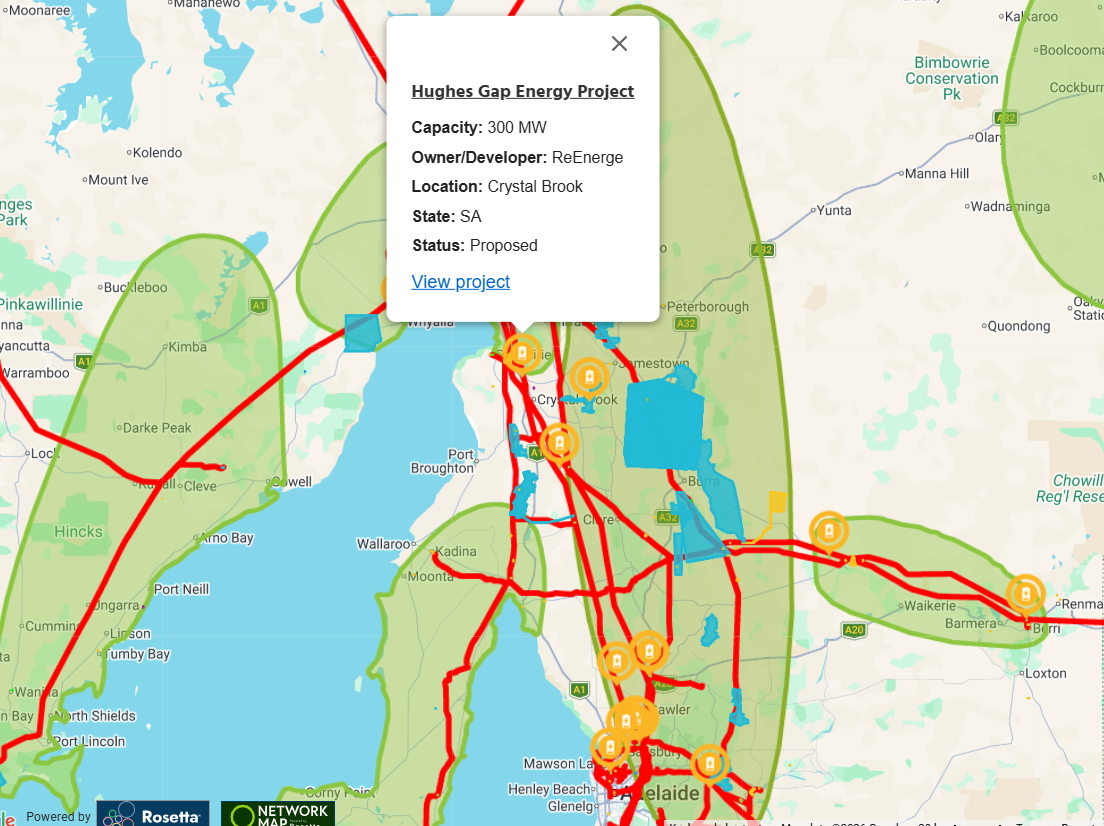

ReEnerge taking its Hughes Gap project to the people

Published Date: 2026-February-26, Thursday

ReEnerge Australia Holdings is planning community

information sessions this week in support of its proposed Hughes Gap Energy Project, to be located . . .

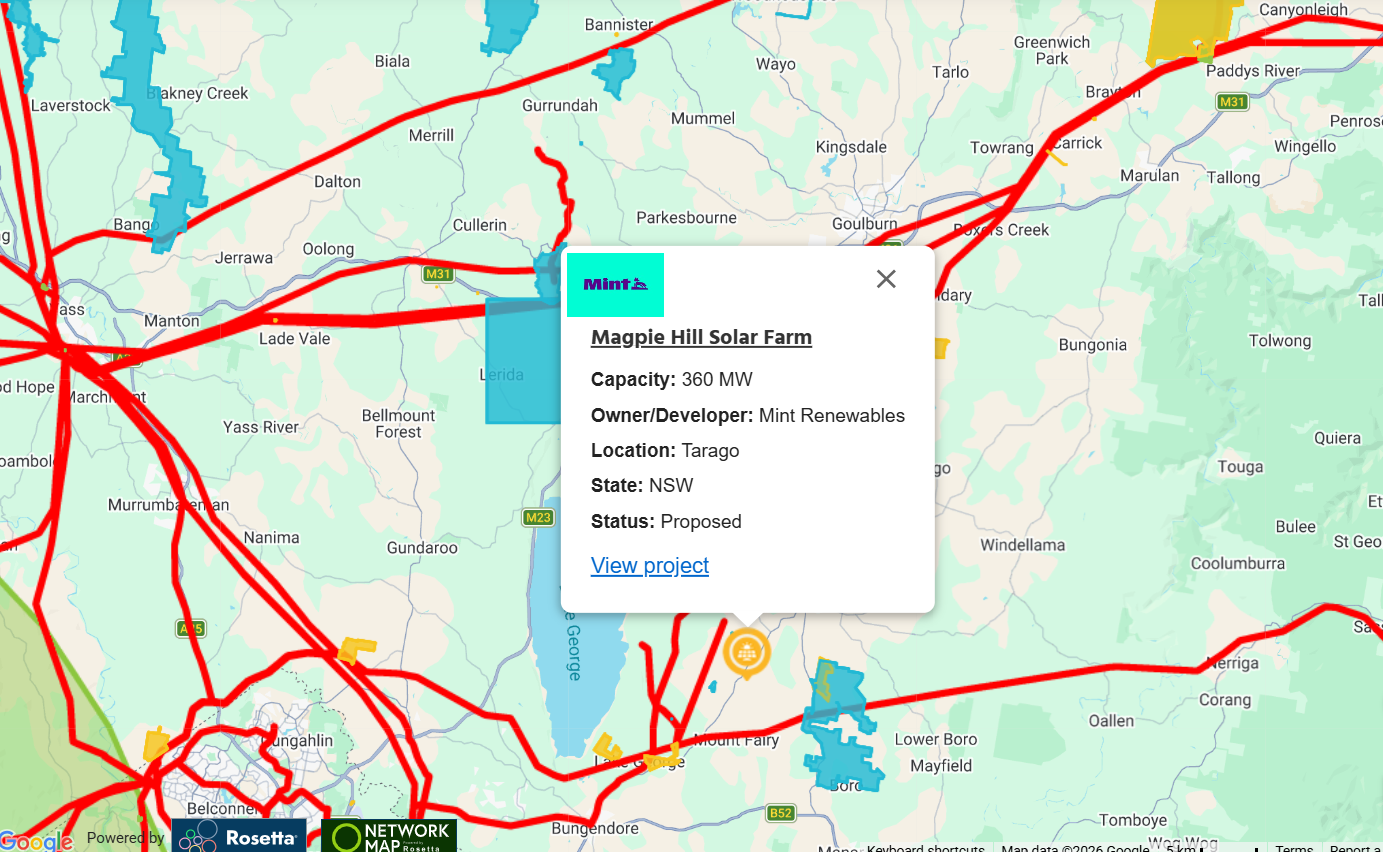

Mint gain one project and lose one; make key appointment in NZ

Published Date: 2026-February-20, Friday

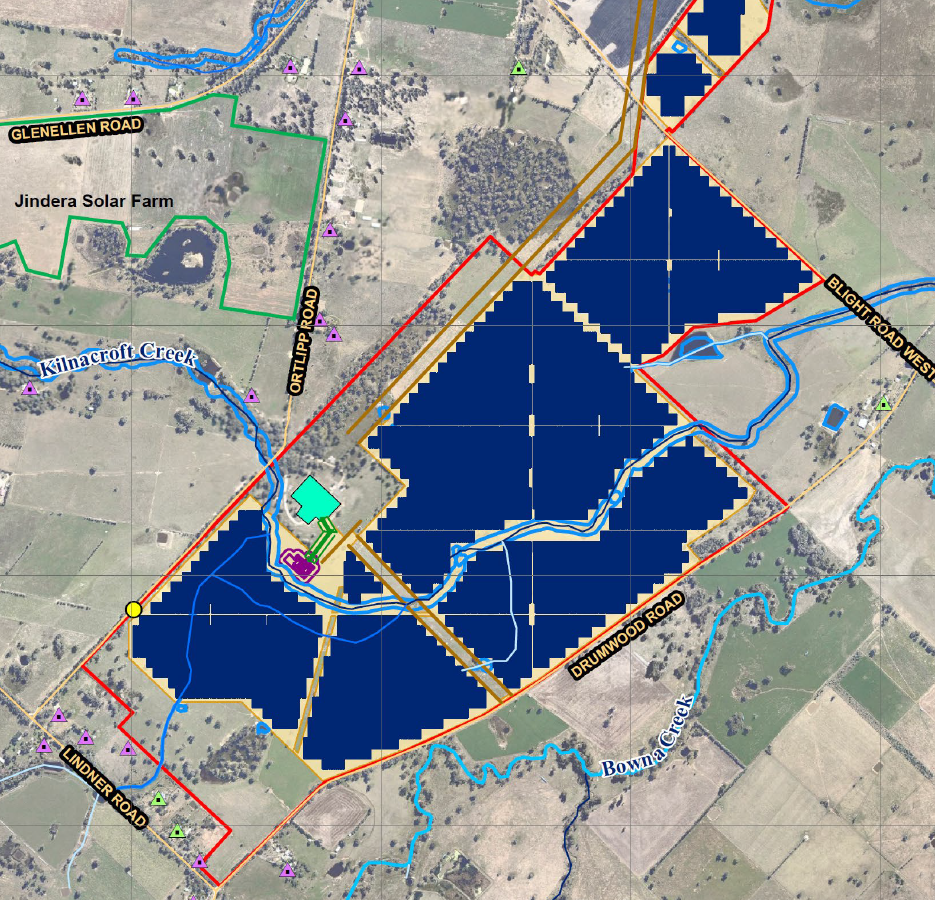

Mint Renewables is planning to develop a new solar farm and BESS

located on a site 6km south-west of Tarago and 17 km north-east of Bungendore

in th . . .

Feds wave through Tarong West Wind Farm

Published Date: 2026-February-20, Friday

The federal DCCEEW’s approval this week of the Tarong West Wind Farm in the South Burnett region will

be of particular interest to the Queensland . . .

Tumuruu Solar Farm could be PEG’s biggest test yet

Published Date: 2026-February-13, Friday

Australian Solar Enterprises (ASE) has lodged a referral for

its proposed Tumuruu Solar Farm, to be located 3.5km

north of Bluckbutt in Queensland, . . .

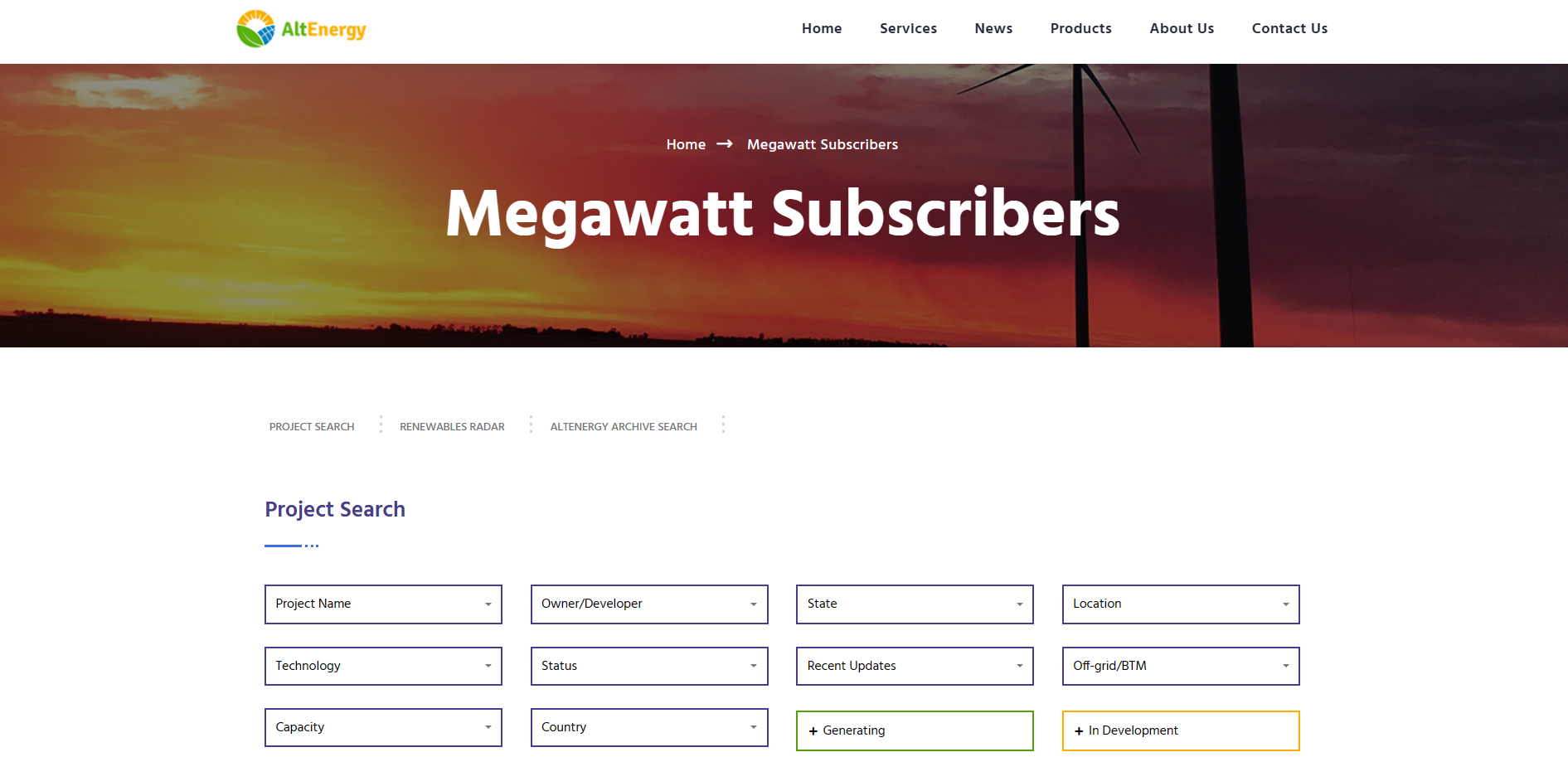

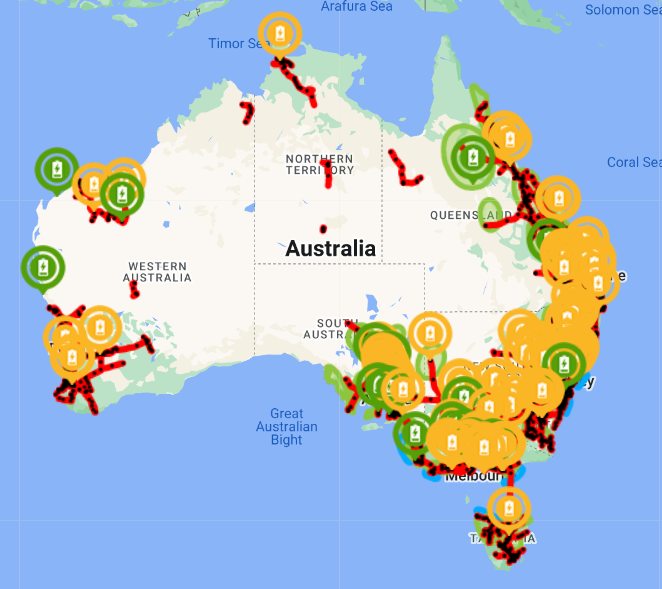

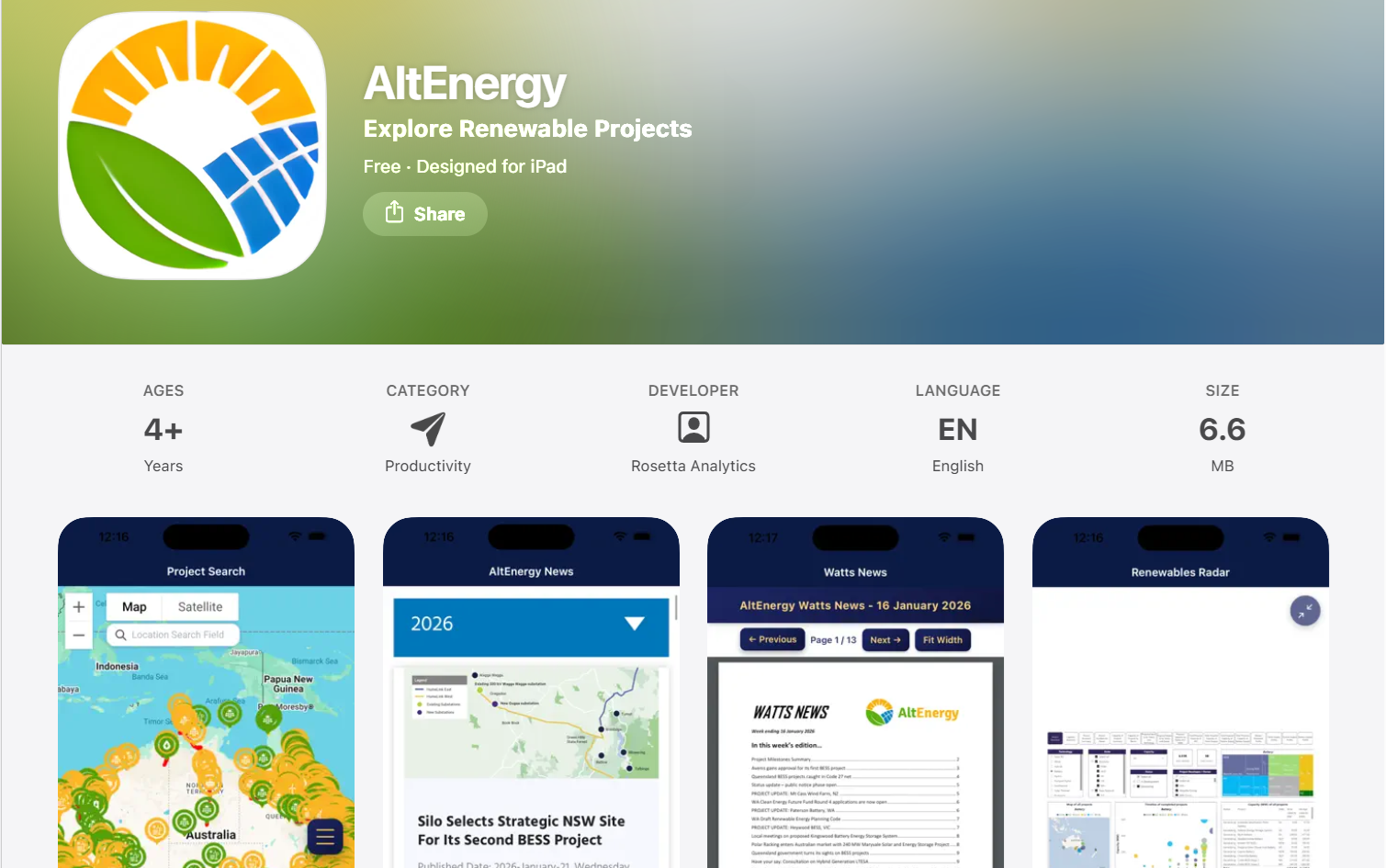

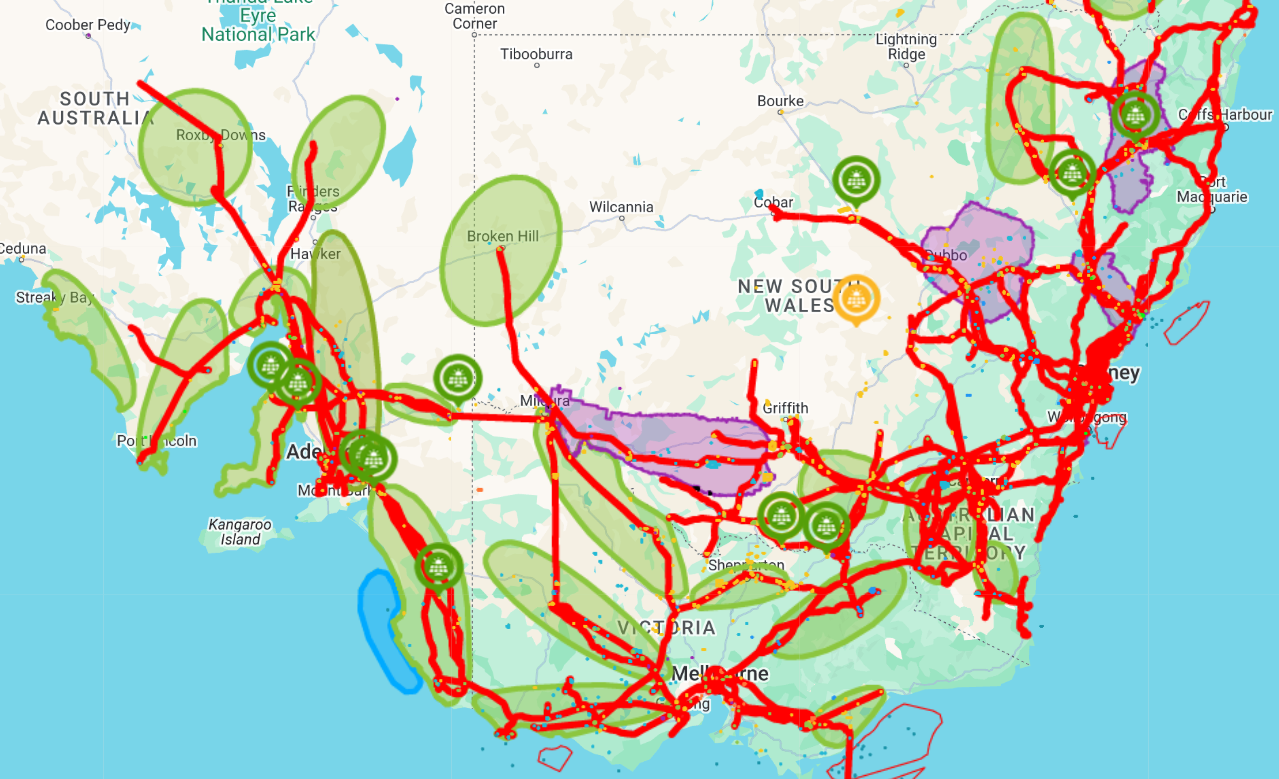

AltEnergy: there’s an app for that

Published Date: 2026-January-28, Wednesday

HIGHLIGHTS

·

Supported by Rosetta Analytics, a new AltEnergy

app is available for iOS Apple and A . . .

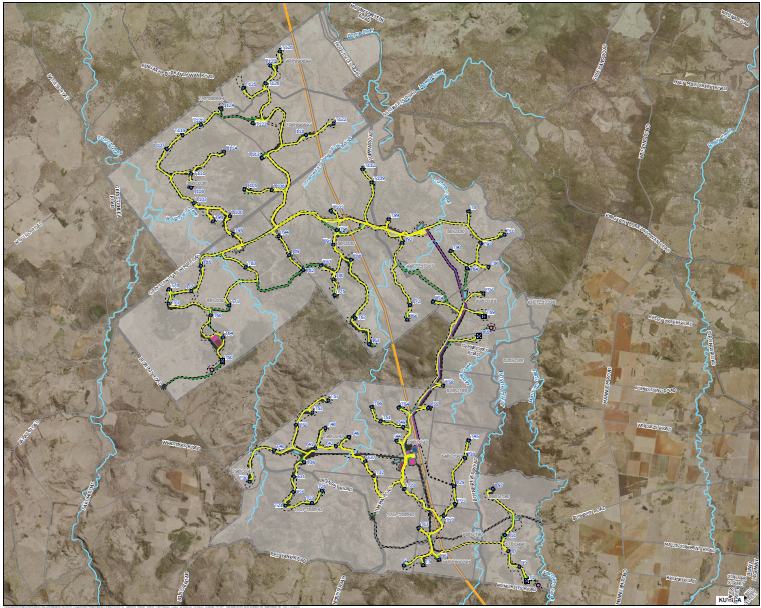

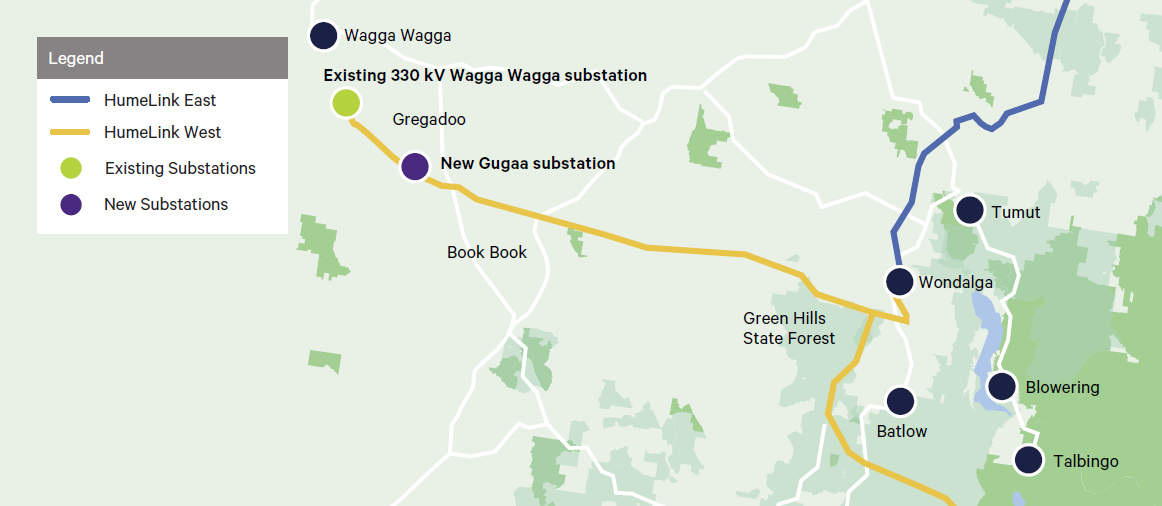

Silo selects strategic NSW site for its second BESS project

Published Date: 2026-January-21, Wednesday

Low-key developer Silo Energy plans to take full advantage

of a strategic site to develop the Gugaa Battery Energy Storage System, to be

located nea . . .

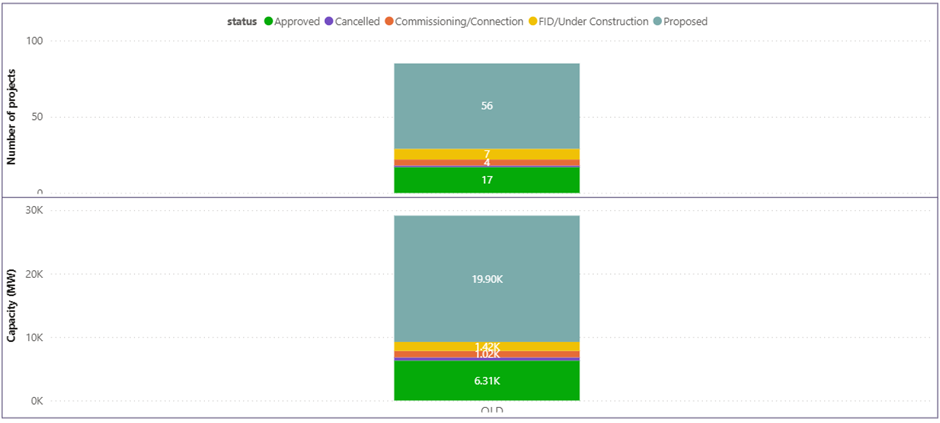

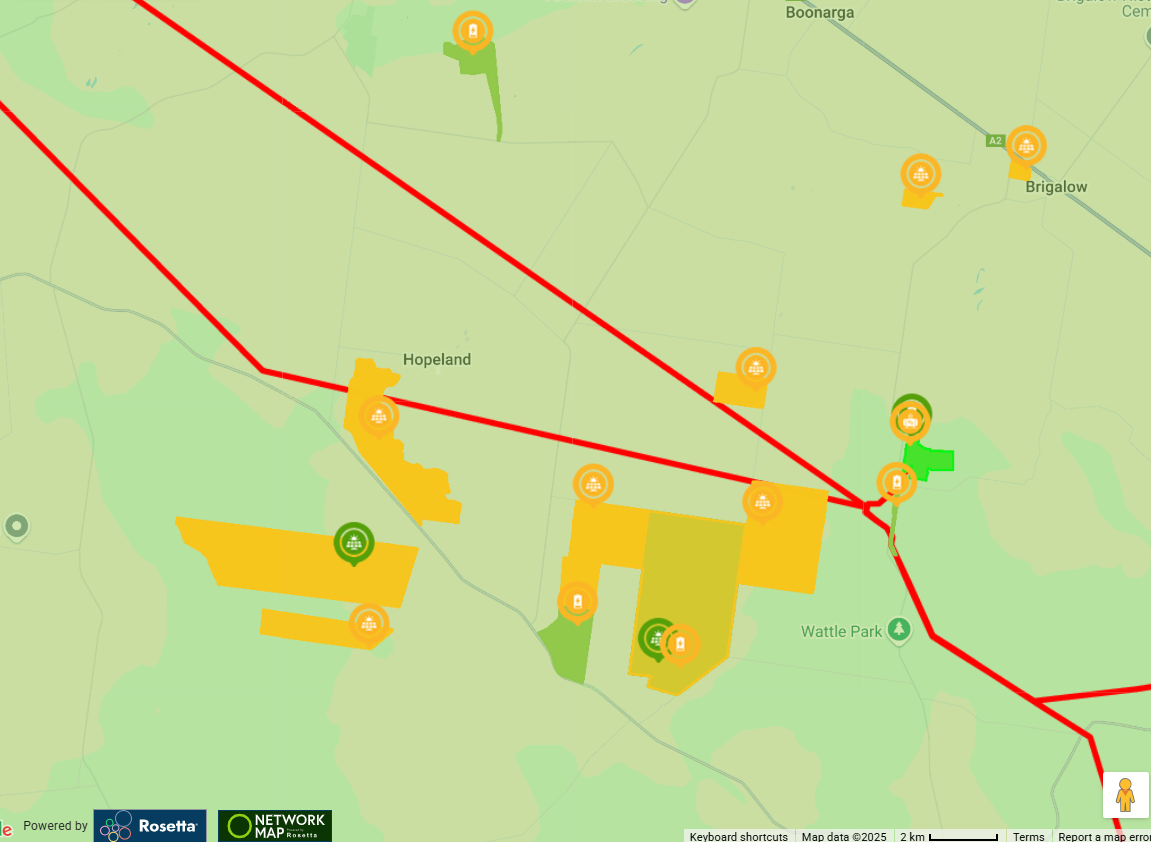

Queensland BESS projects caught in Code 27 net

Published Date: 2026-January-16, Friday

In more evidence of the damage and delay the Queensland

state government’s new BESS planning laws are causing, RWE Renewables will incur developmen . . .

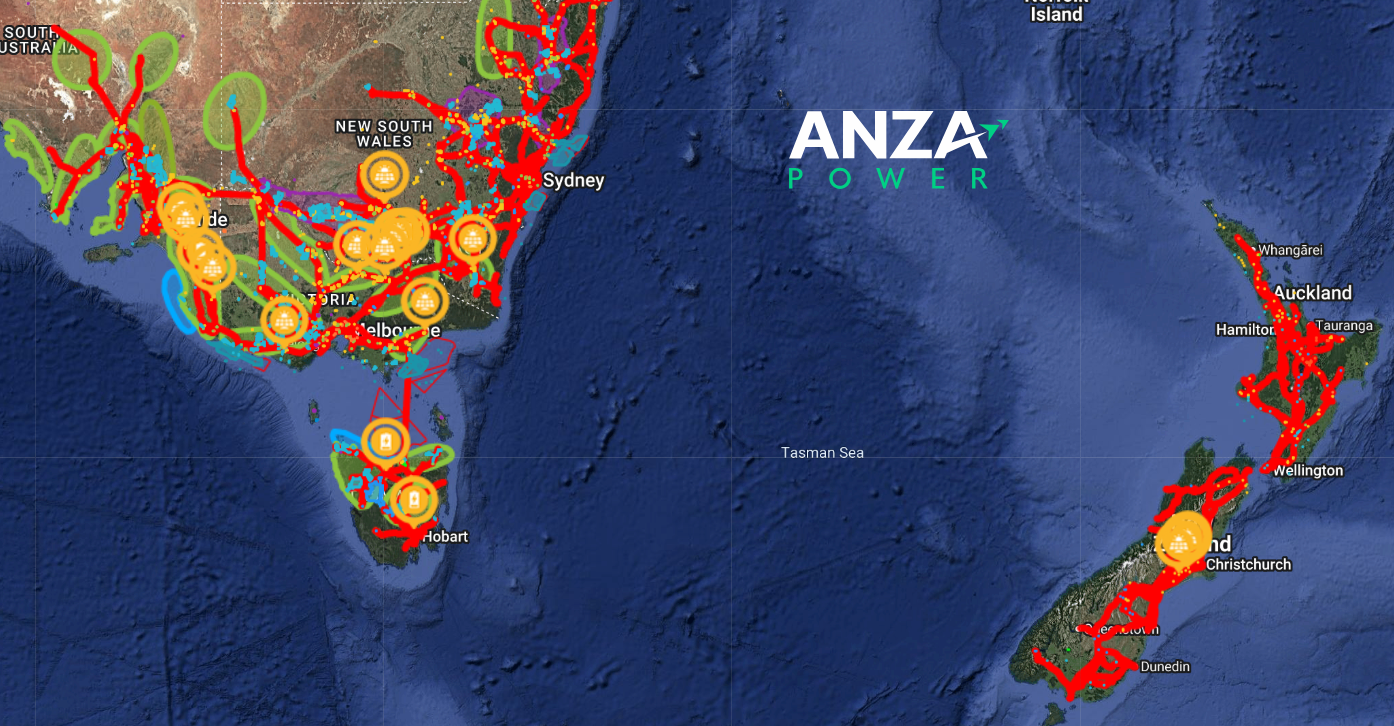

Bison Energy AUS/NZ project portfolio herded up by ANZA Power

Published Date: 2026-January-14, Wednesday

Bison Energy Australia has transmogrified into ANZA Power, backed

by long-term institutional investor I Squared Capital and a US$300 million

equity . . .

AltEnergy’s year ends with a bang, and a website upgrade

Published Date: 2025-December-10, Wednesday

HIGHLIGHTS 2025 is ending with an incredibly high level of

industry activity; 2026 should be bigger AltEnergy has just completed a website upgrade . . .

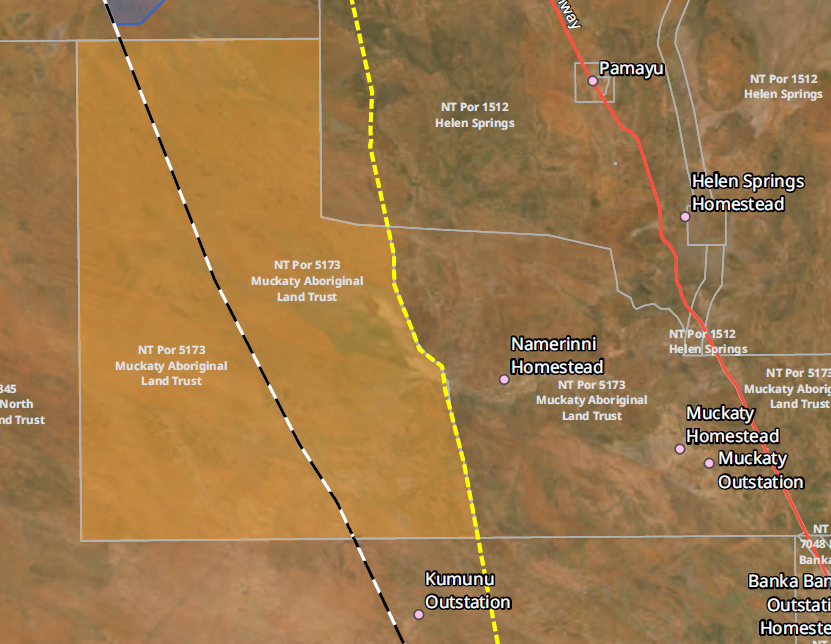

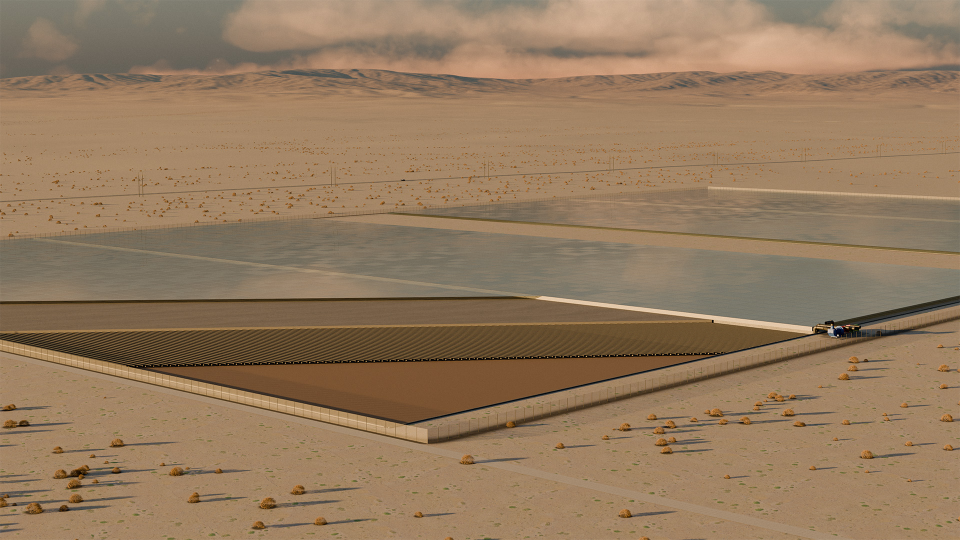

Total, Eren planning totally huge solar farm in the NT

Published Date: 2025-December-9, Tuesday

TE H2, a partnership between TotalEnergies and EREN Groupe,

is planning a gigantic 2700 MW solar farm approximately 48km south-east of

Darwin and 8k . . .

The backstory with CPVA's Laura Jones

Published Date: 2025-December-2, Tuesday

Circular PV

Alliance (CPVA) recently certified ACEN Australia’s 400MW Stubbo Solar Farm

under the CPVA Certified™ program, meaning almost 1 mill . . .

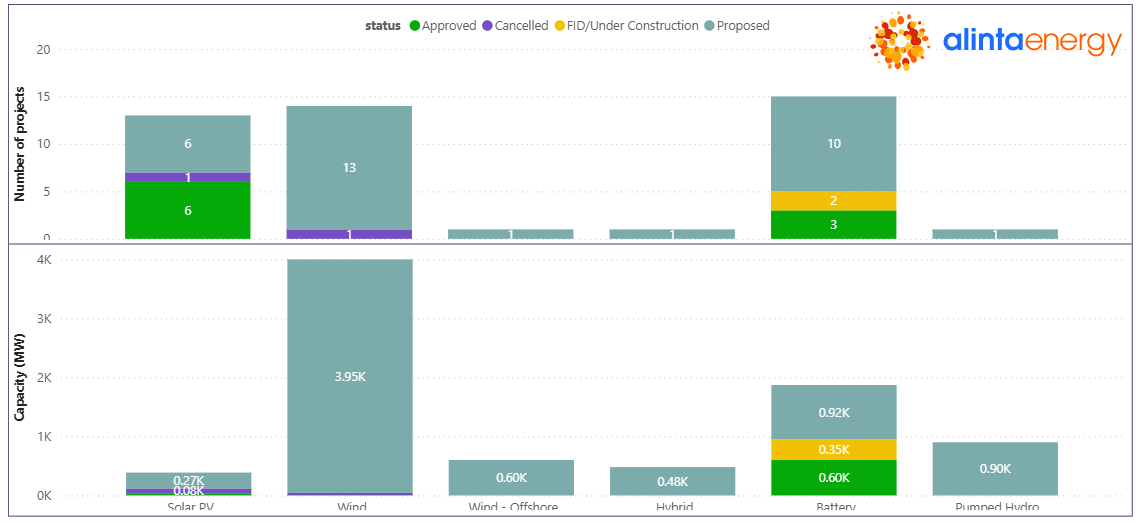

Alinta takes the steering wheel for Mount Lambie Wind Farm approvals

Published Date: 2025-November-27, Thursday

With the acquisition of Tetris Energy in July, Alinta Energy

added a 3.2 GW portfolio of early-stage wind, solar and storage projects across

the NEM . . .

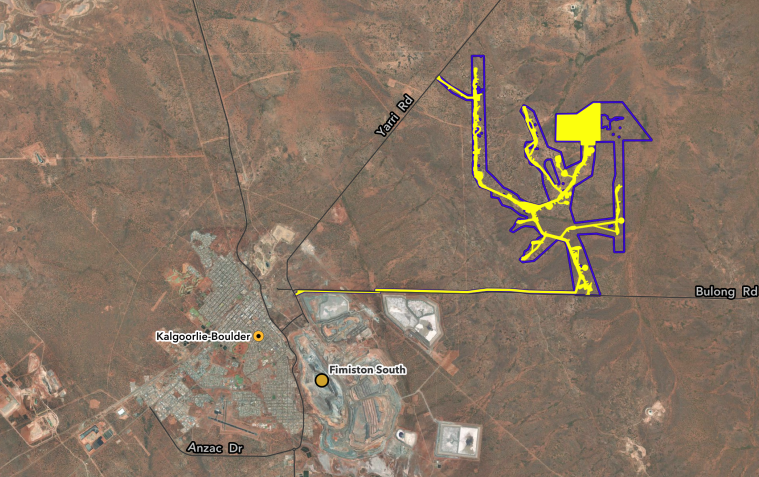

Northern Star ups the capacity at its latest minesite energy proposal

Published Date: 2025-November-25, Tuesday

Northern Star Resources is planning to take on its largest

renewable energy project to date, the 366 MW Kalgoorlie Regional Renewable

Energy Project . . .

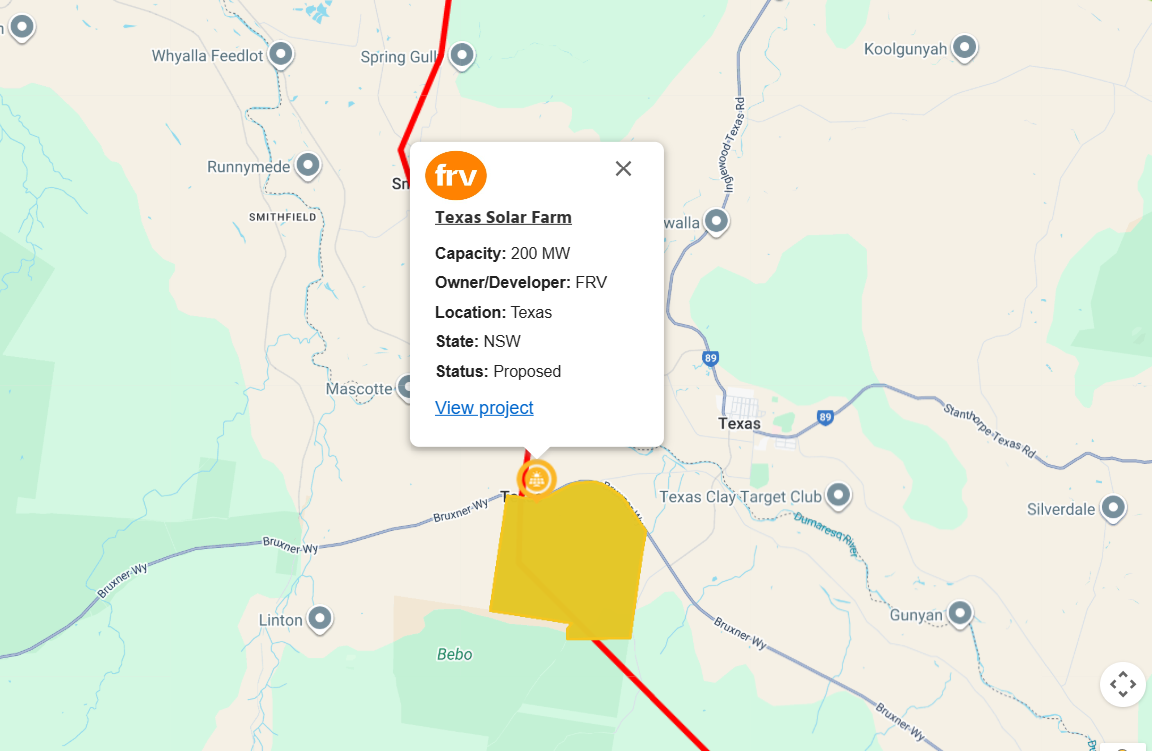

Solar smaller, BESS bigger in Texas

Published Date: 2025-November-21, Friday

FRV Australia has modified the configuration of its proposed

Texas Solar Farm and BESS in far northern NSW, just south of the Queensland border

near . . .

Unique wind (hobby) farm preparing for a reset

Published Date: 2025-November-14, Friday

The owners of a private 2-turbine wind project in Hampton,

within NSW’s Lithgow City Council, are planning to replace the ageing infrastructure

ne . . .

Mad Monday positions QIC as a significant project developer

Published Date: 2025-November-11, Tuesday

Queensland Investment Corporation (QIC) strengthened its position

in the Australian renewable energy project development market by announcing two

si . . .

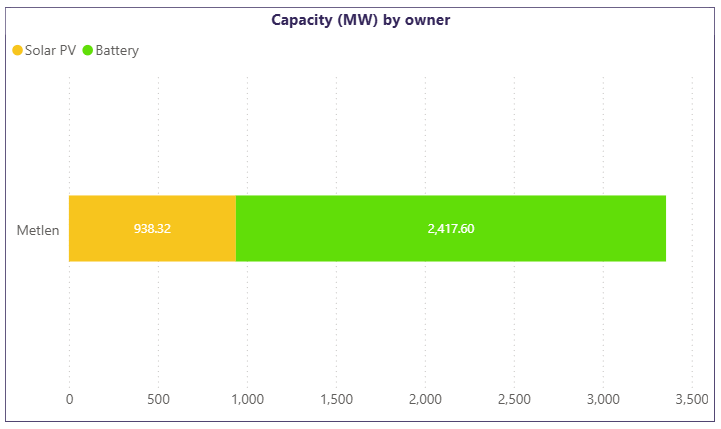

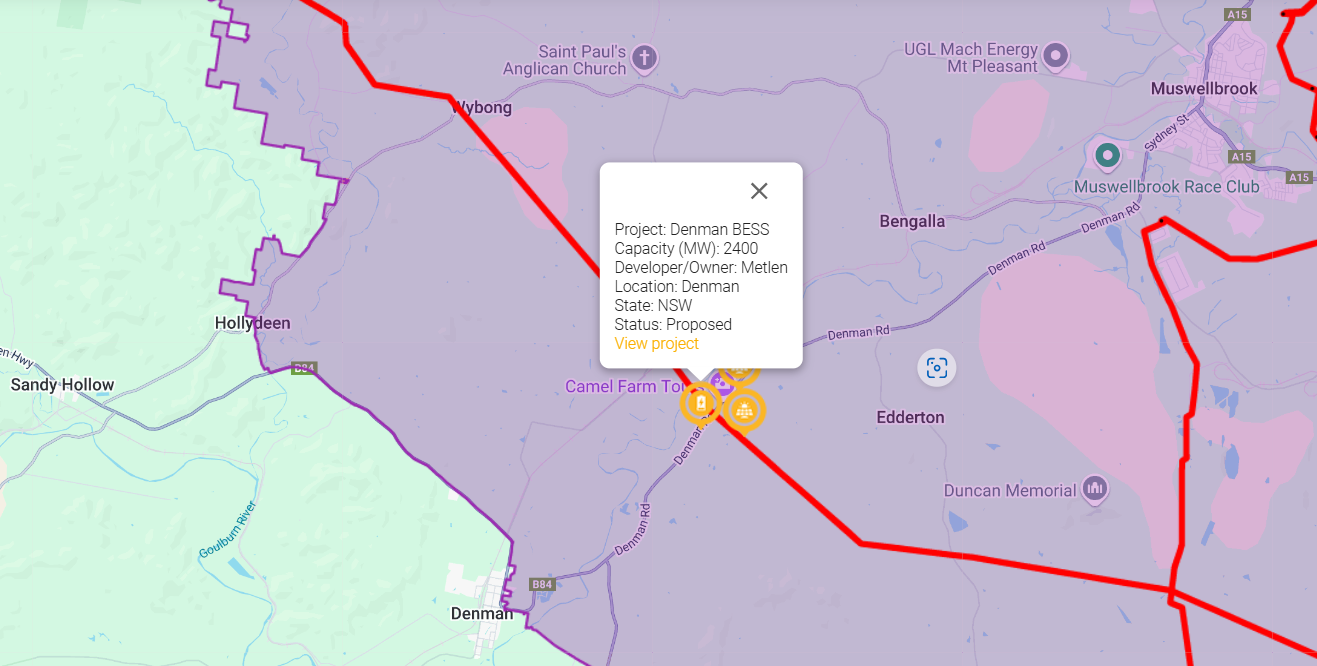

Metlen closing in on sale of its Australian projects

Published Date: 2025-November-7, Friday

In its latest trading update, Metlen Energy & Metals

informs the market that it is close to completing deals to sell its Australian

and UK renew . . .

Massive expansion of Australia-Asia PowerLink solar capacity planned

Published Date: 2025-October-31, Friday

SunCable is planning to inject a lot more capacity into its Australia-Asia PowerLink Project by development of a large-scale solar generation and BESS . . .

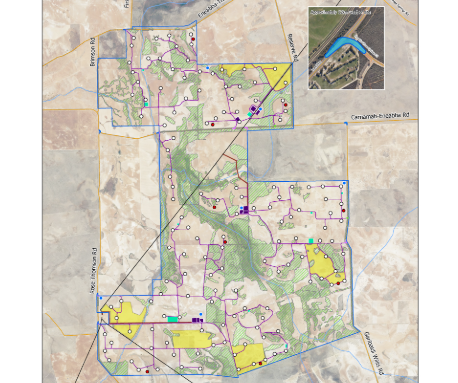

Synergy looks to have all Mid West bases covered

Published Date: 2025-October-9, Thursday

WA state-owned

gentailer Synergy’s Tathra Wind Farm project, proposed on a site 15km east of Eneabba in the

Mid-West Region of Western Australia, . . .

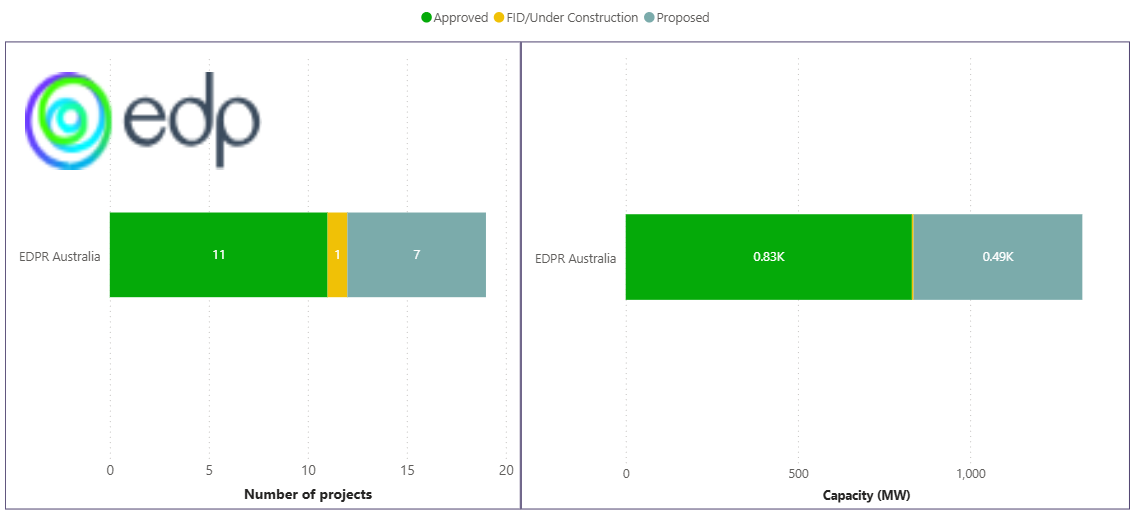

Burst of activity for EDPR Australia

Published Date: 2025-October-7, Tuesday

EDP Renewables Australia (EDPR) has been active over the

last month or two acquiring a 400 MW solar farm project, submitting a development

applicati . . .

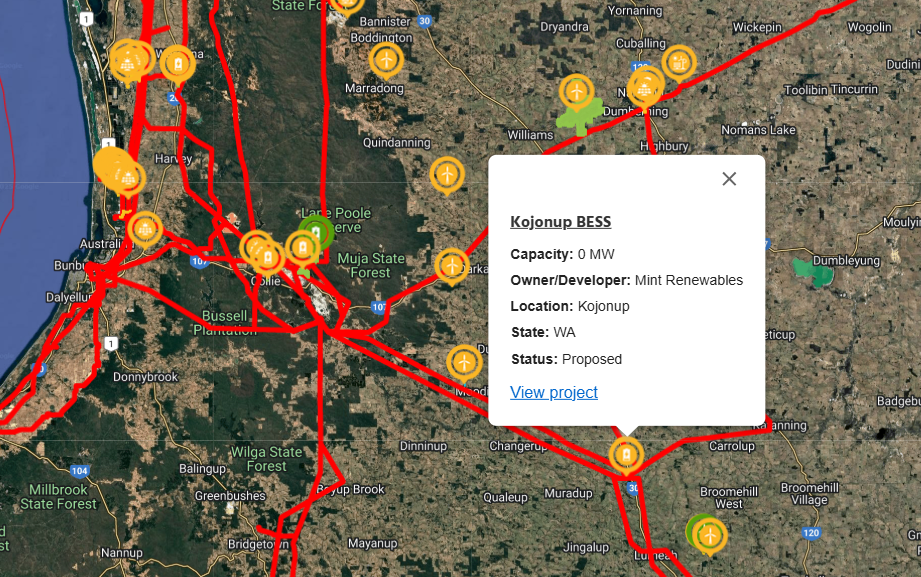

Mint seeking to install a new battery in WA's Great Southern region

Published Date: 2025-October-1, Wednesday

Mint Renewables is planning community consultation sessions

for its Kojonup BESS project, proposed on a site located 3km north-west of

Kojonup adjac . . .

Gas-fired power to meet data centre expansion plans

Published Date: 2025-September-25, Thursday

Here is a type of development application we are sure to see

more of; to build a power supply for a new data centre.

Nakar Property Pty Ltd is se . . .

EnviroMission reemerges with a new mission

Published Date: 2025-September-23, Tuesday

Well this was a blast from the past. AltEnergy, then known

as RENergy, was writing about a company called EnviroMission in the early

2000s.

At t . . .

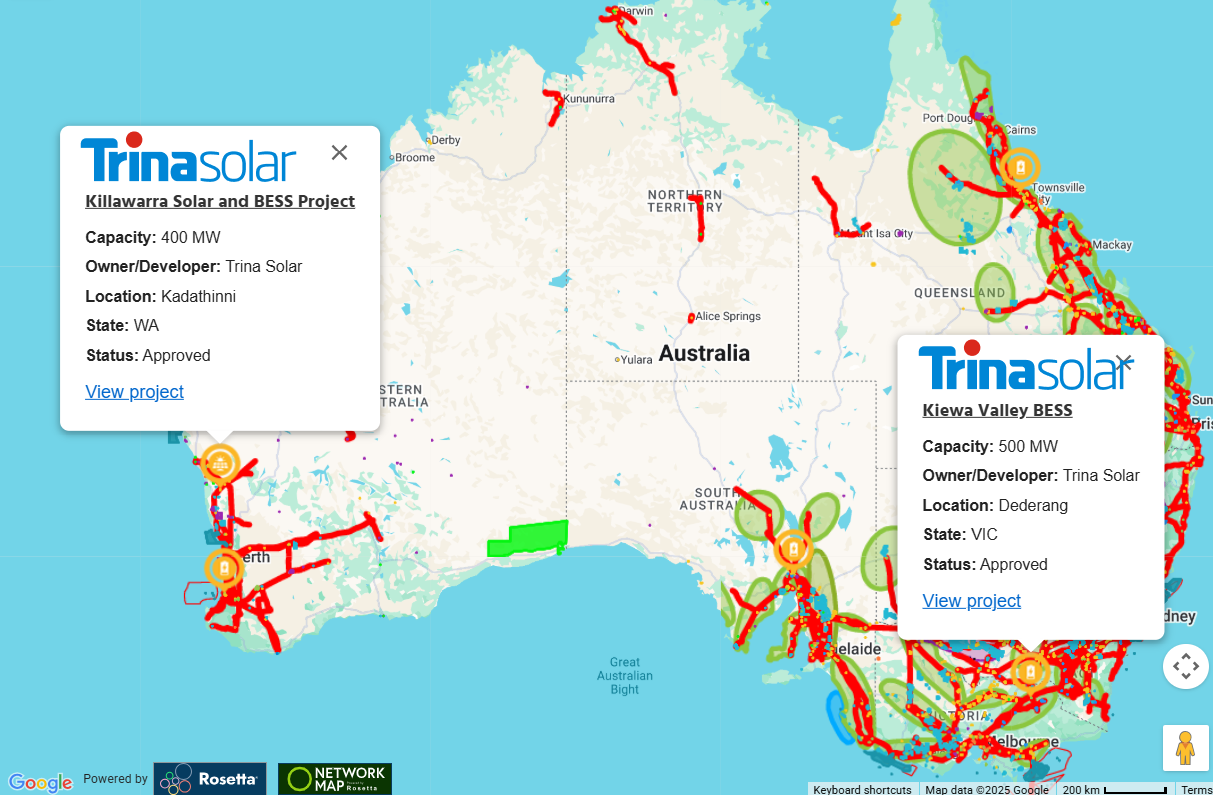

Two approvals in a week for Trina Solar projects

Published Date: 2025-September-18, Thursday

Better known for its PV panel manufacturing, China’s Trina

Solar had an eventful week in terms of renewable energy project approvals on

either sid . . .

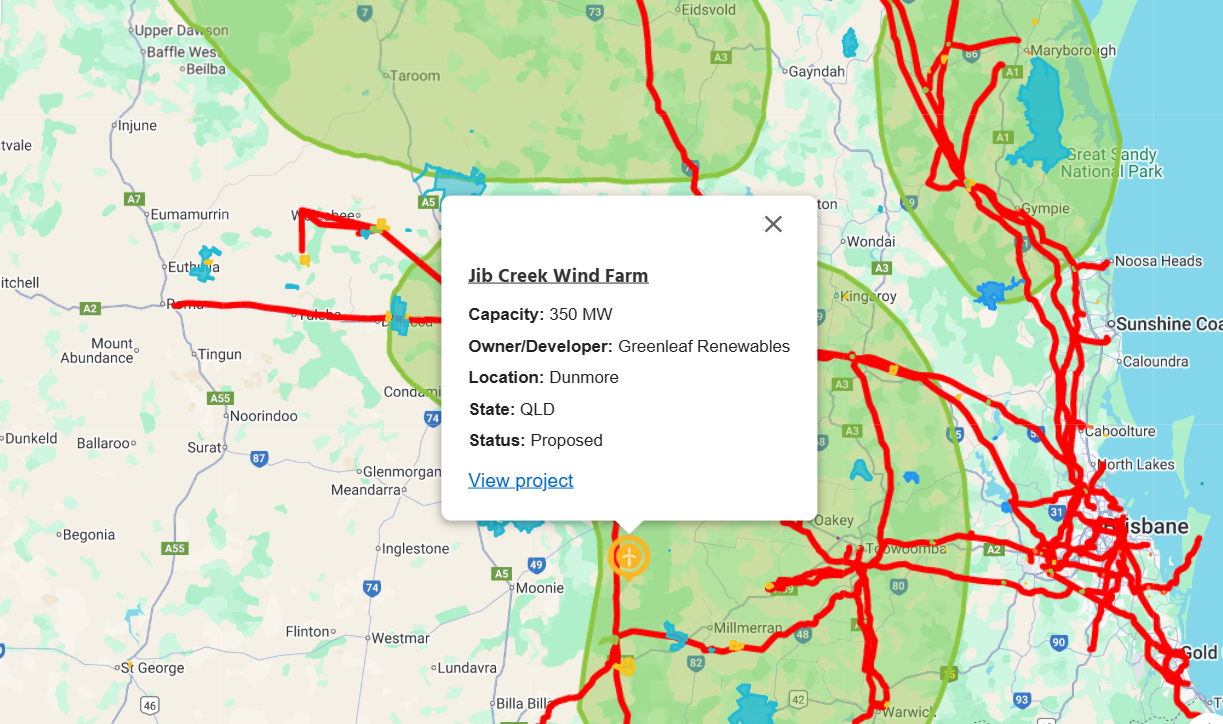

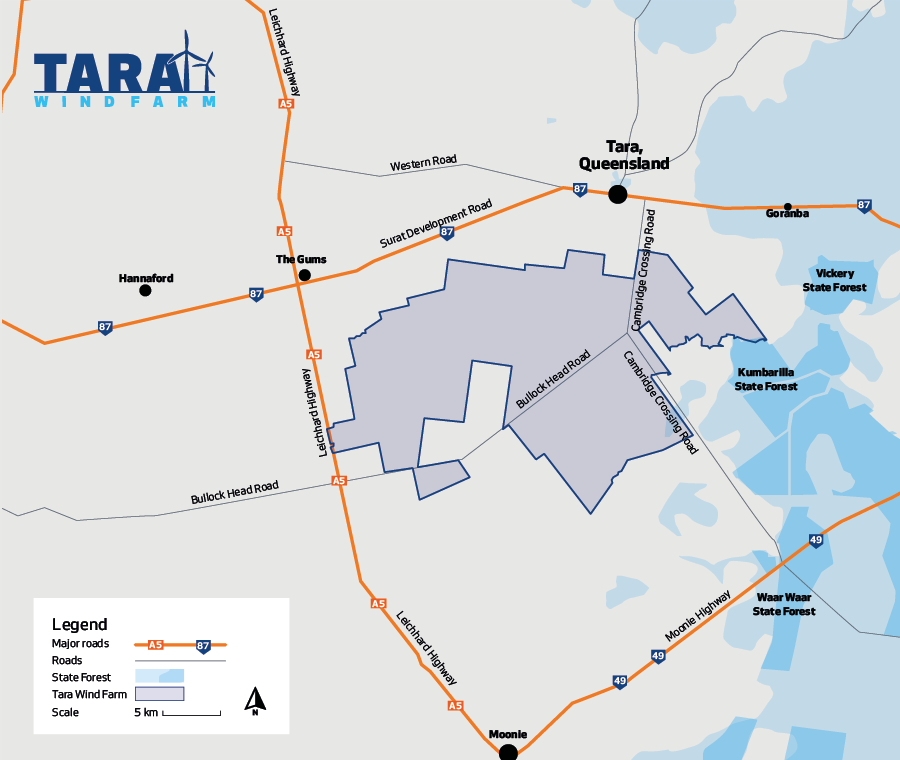

Greenleaf turns attention to another of its proposed Queensland wind farms

Published Date: 2025-September-11, Thursday

Greenleaf Renewables is moving past the disappointment of

its Moonlight Range Wind Farm development approval being refused by the

Queensland state g . . .

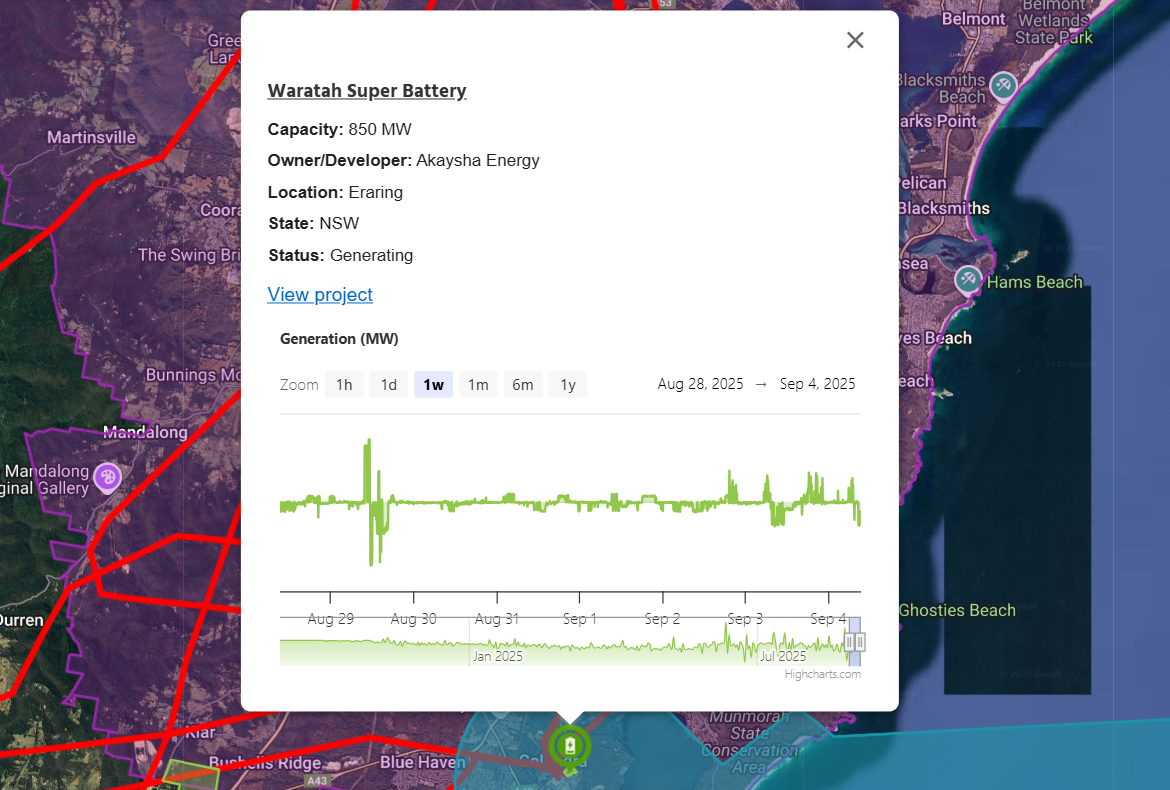

Akaysha’s big battery rollout continues at speed

Published Date: 2025-September-4, Thursday

Akaysha Energy has well and truly released the handbrake on

its big battery ambitions closing a A$300 million corporate debt facility and

continuing . . .

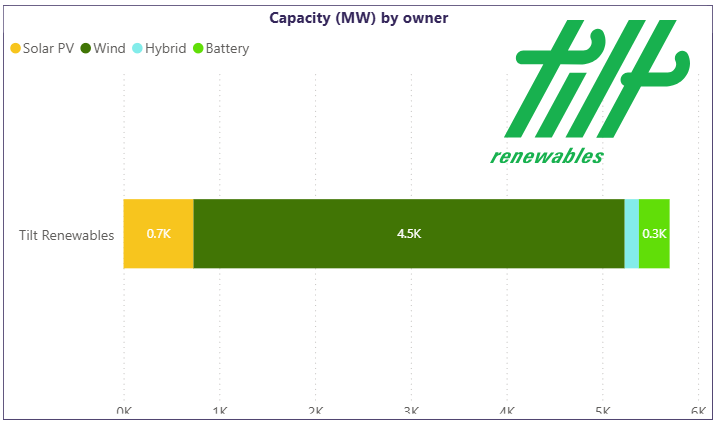

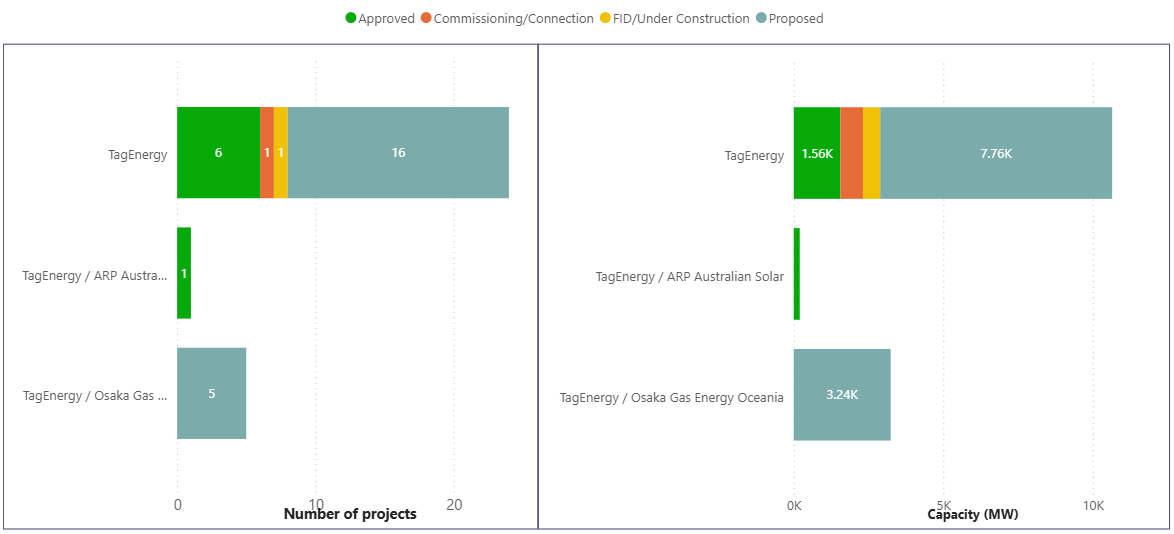

TagEnergy jumps up the developer rankings

Published Date: 2025-August-29, Friday

TagEnergy’s absorption of ACE Power will create one of

Australia’s biggest renewable energy developers by capacity and project numbers.

ACE . . .

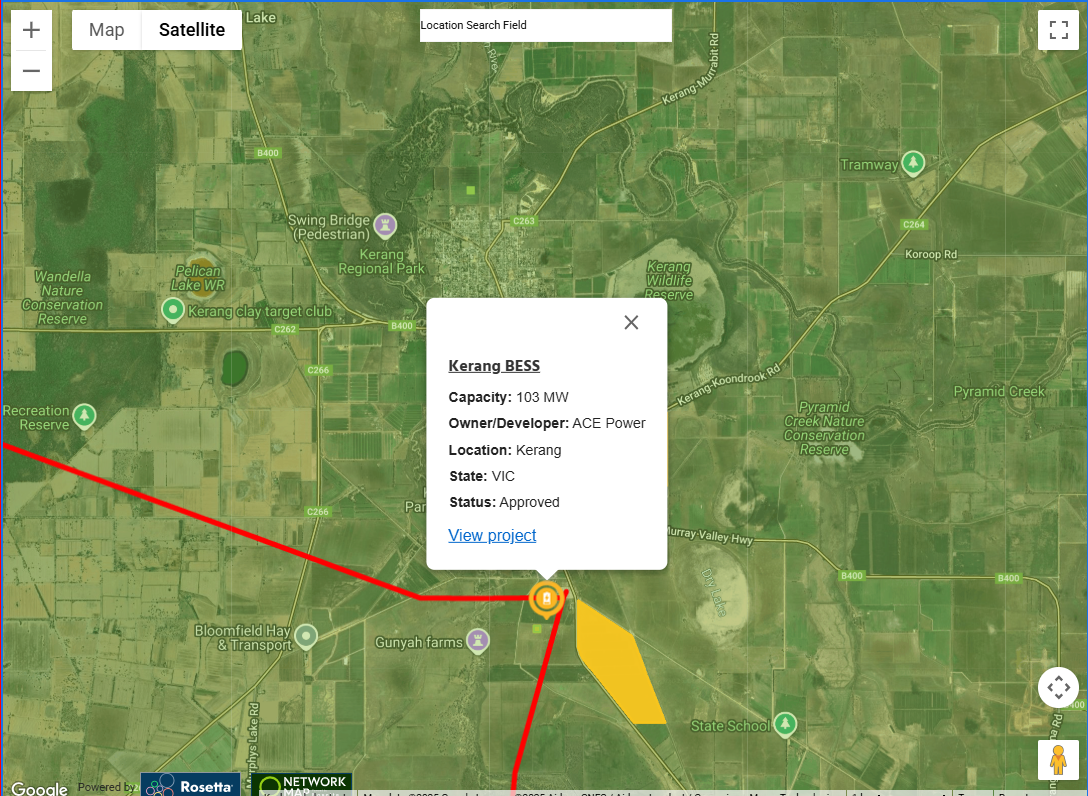

Banpu expands Australian footprint with Kerang Battery acquisition

Published Date: 2025-August-21, Thursday

Banpu Energy Australia adds a new battery project to its

portfolio, acquiring the shovel-ready 103 MW / 206 MWh grid-forming Kerang BESS

in Victoria . . .

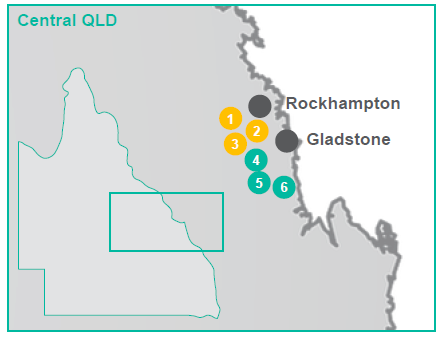

Stake in +2 GW Central Queensland solar, wind and BESS portfolio up for sale

Published Date: 2025-August-15, Friday

A RES Australia / Energy Estate joint venture is offering an

equity interest in its Central Queensland Power’s (CQP) portfolio of wind and

solar / . . .

Hargraves Energy Project Launches Green Belt Energy’s regional vision

Published Date: 2025-August-14, Thursday

Green Belt Energy, a new joint venture between Energy Estate and

Efficacy Advisors, is progressing development of its first project located in

the C . . .

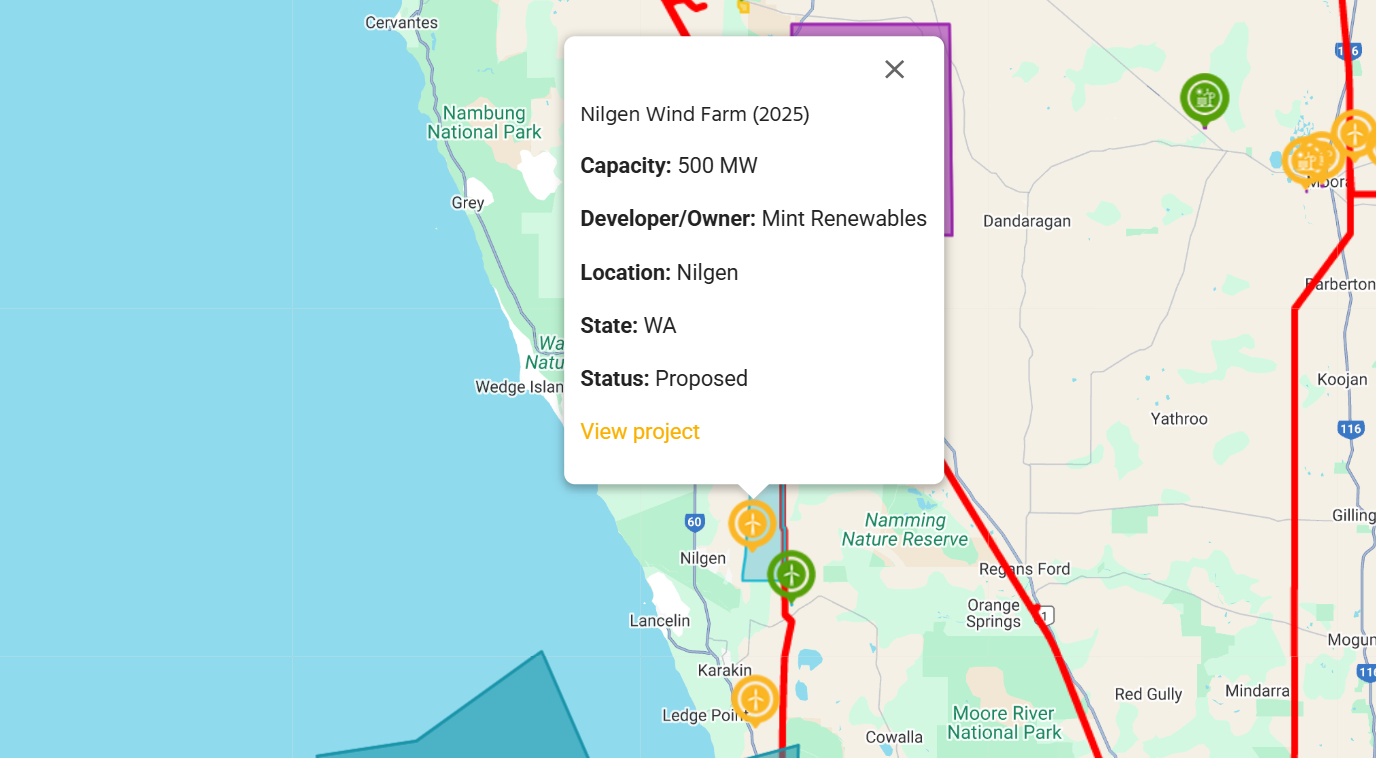

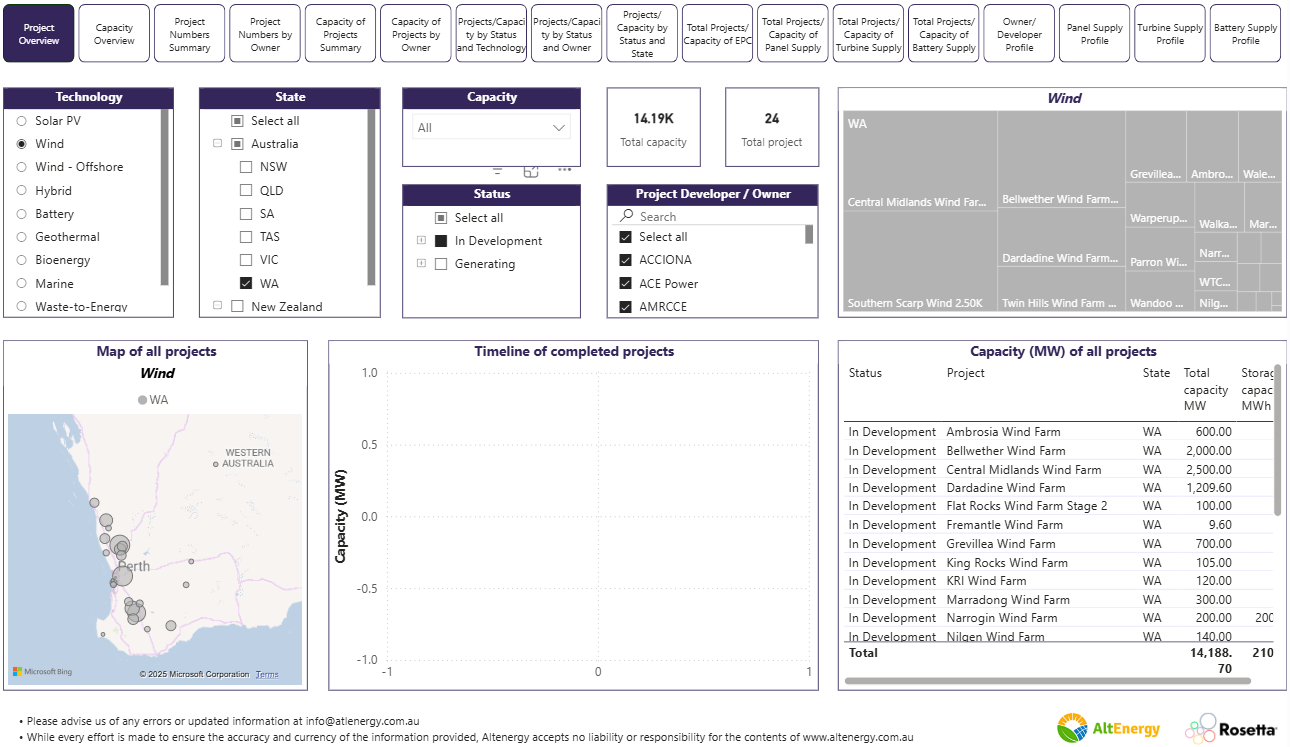

Nilgen Wind Farm gets the fresh Mint treatment

Published Date: 2025-August-6, Wednesday

Mint Renewables is refreshing plans for a wind farm to be located

east of Nilgen, around 130km north of Perth in Western Australia. Mint is investiga . . .

Armidale attracts a new BESS proposal

Published Date: 2025-July-25, Friday

Edify Energy has submitted a scoping report for its proposed

Kooyong BESS, to be located near Armidale in northern NSW, for assessment by

the state . . .

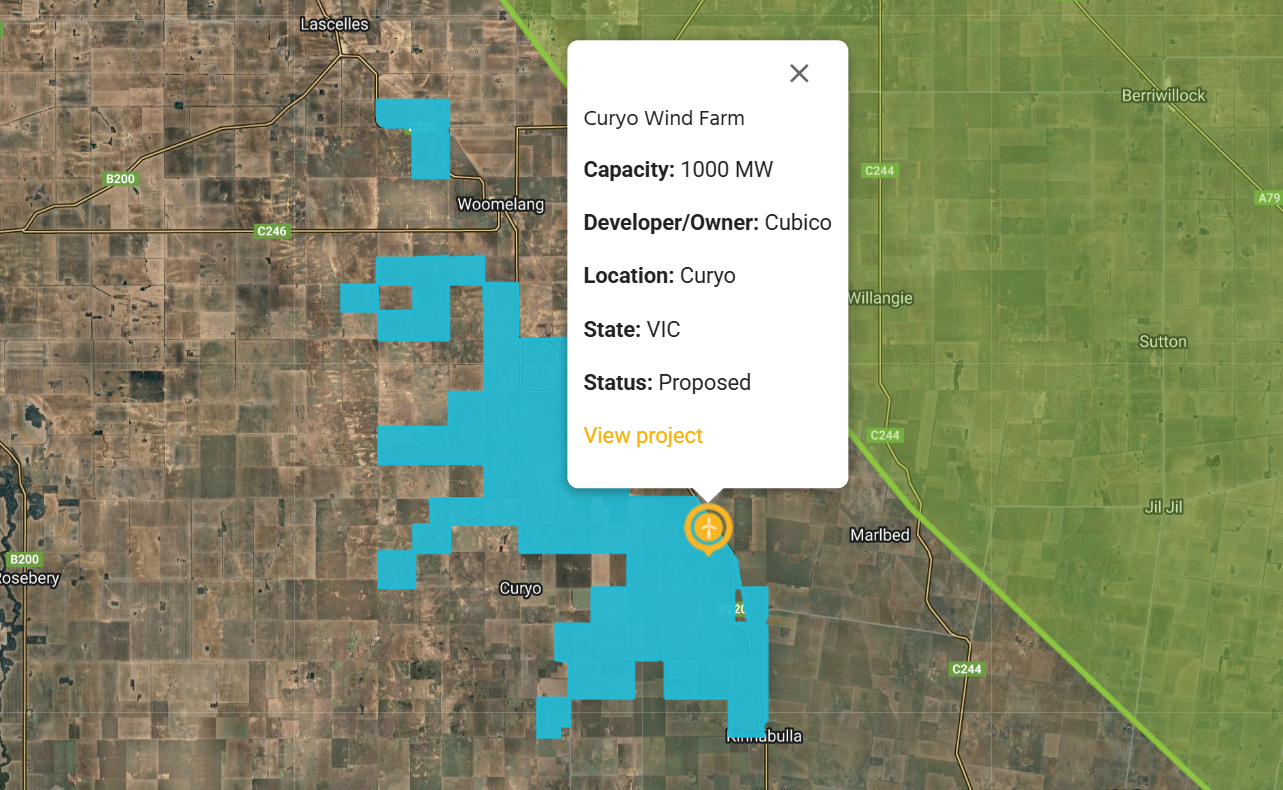

Massive wind farms planned in NSW and Victoria

Published Date: 2025-June-27, Friday

A scoping report for Neoen Energy’s proposed Bondo Wind Farm, to be located within the softwood

plantations near Bondo - approximately 20km east of . . .

Eastern Brown Snakes all in a day’s work for Fauna Spotters Pty Ltd

Published Date: 2025-June-18, Wednesday

INTRODUCTION

At AltEnergy we are always interested to come across

unusual, niche jobs associated with the wind and solar farm development and

co . . .

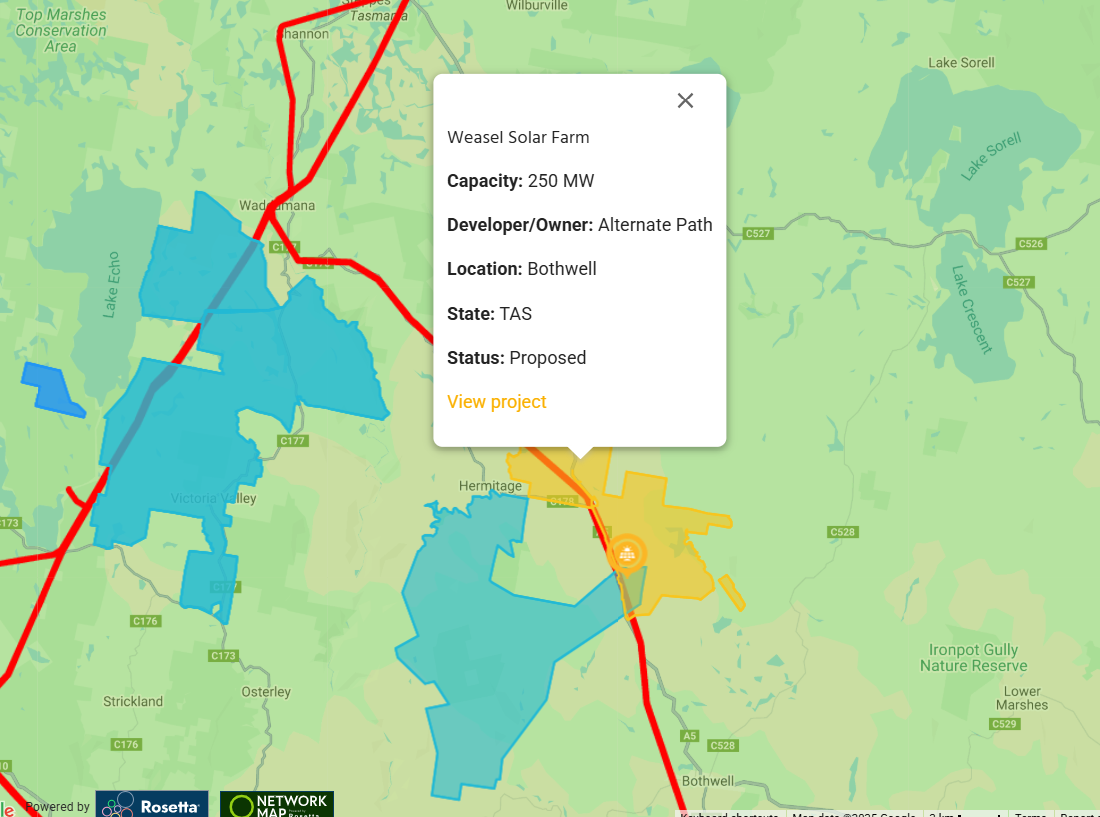

Tasmanian solar farm weasels its way through federal approval process

Published Date: 2025-May-28, Wednesday

Alternate Path’s proposed 250 MW Weasel

Solar Farm and BESS in the Central Highlands region of Tasmania has been

declared a non-controlled action . . .

AEMO grid connection team on a roll

Published Date: 2025-May-21, Wednesday

It seems the AEMO connections department has taken to

drinking extra-strong coffee lately with a recent burst of 5.3.4A letters

issued to renewable . . .

Tetris Energy; growing in ambition and scope

Published Date: 2025-May-15, Thursday

Since its inception in 2018, Tetris Energy has steadily grown

in ambition and scope to now have almost 4.2 GW

under development with a

. . .

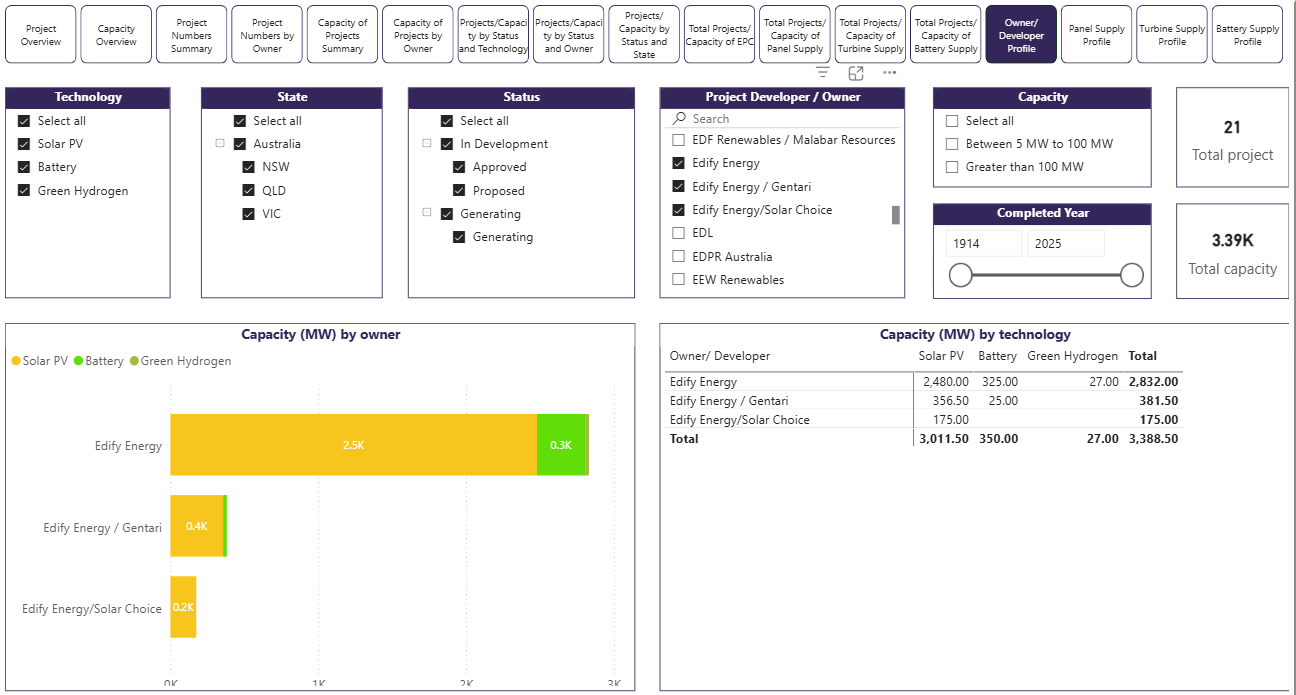

Edify Energy pushes forward its NSW projects

Published Date: 2025-May-2, Friday

Edify Energy’s Peninsula Solar Farm, to be located at

Paytens Bridge approximately 27km south-east of Forbes, has been approved under

the EPBC Act . . .

Two new projects planned for WA’s windy Wheatbelt

Published Date: 2025-April-30, Wednesday

Japanese giant Sumitomo Corporation is expanding its Western

Australian energy operations by planning to build the Marradong

Wind Farm, south of Bod . . .

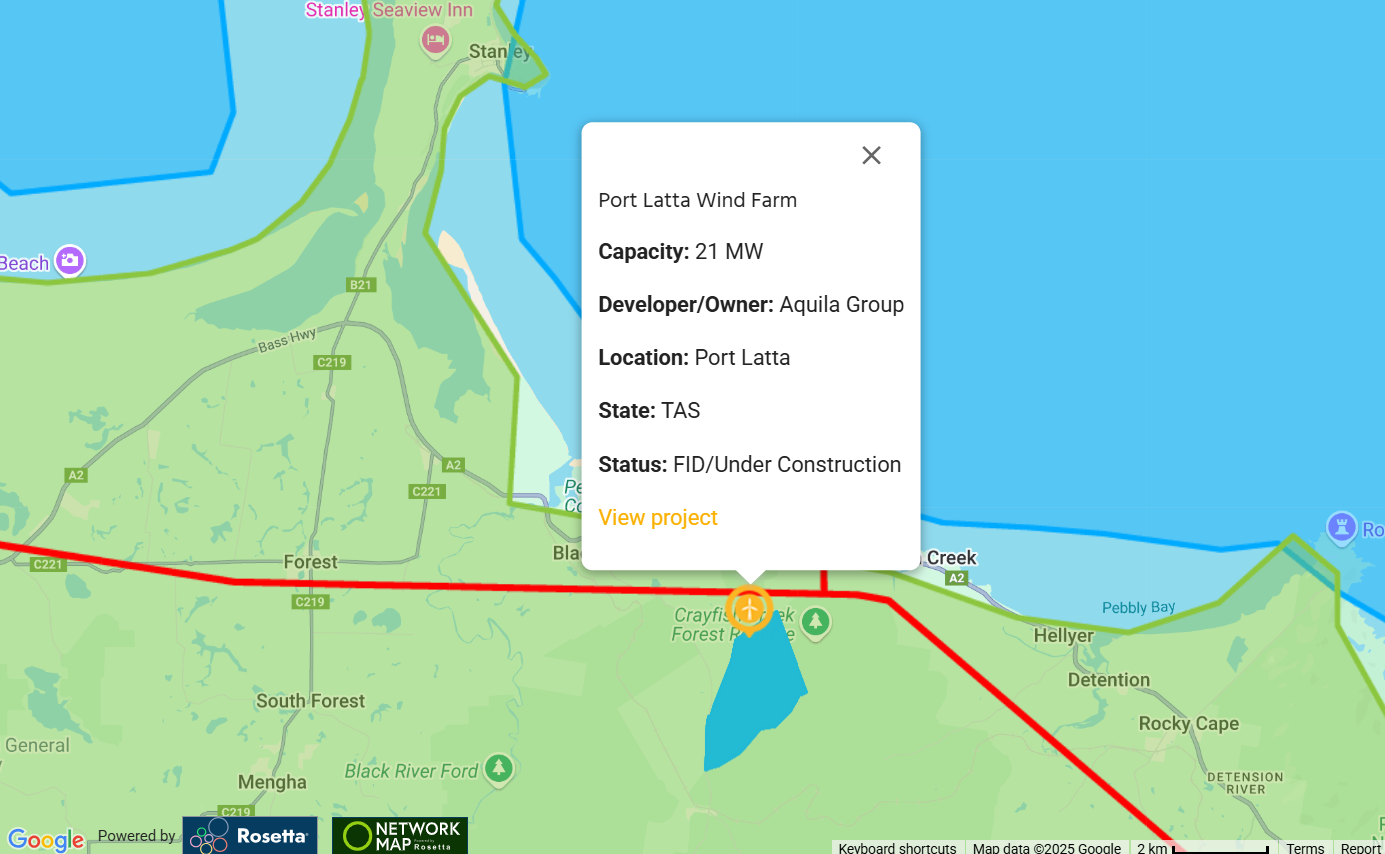

Wind farms quietly pushed ahead into late development stage by new owners

Published Date: 2025-April-17, Thursday

Since acquiring the Port Latta Wind Farm in the middle of

2022 Aquila Clean Energy Asia Pacific has quietly gone about the business of

preparing the . . .

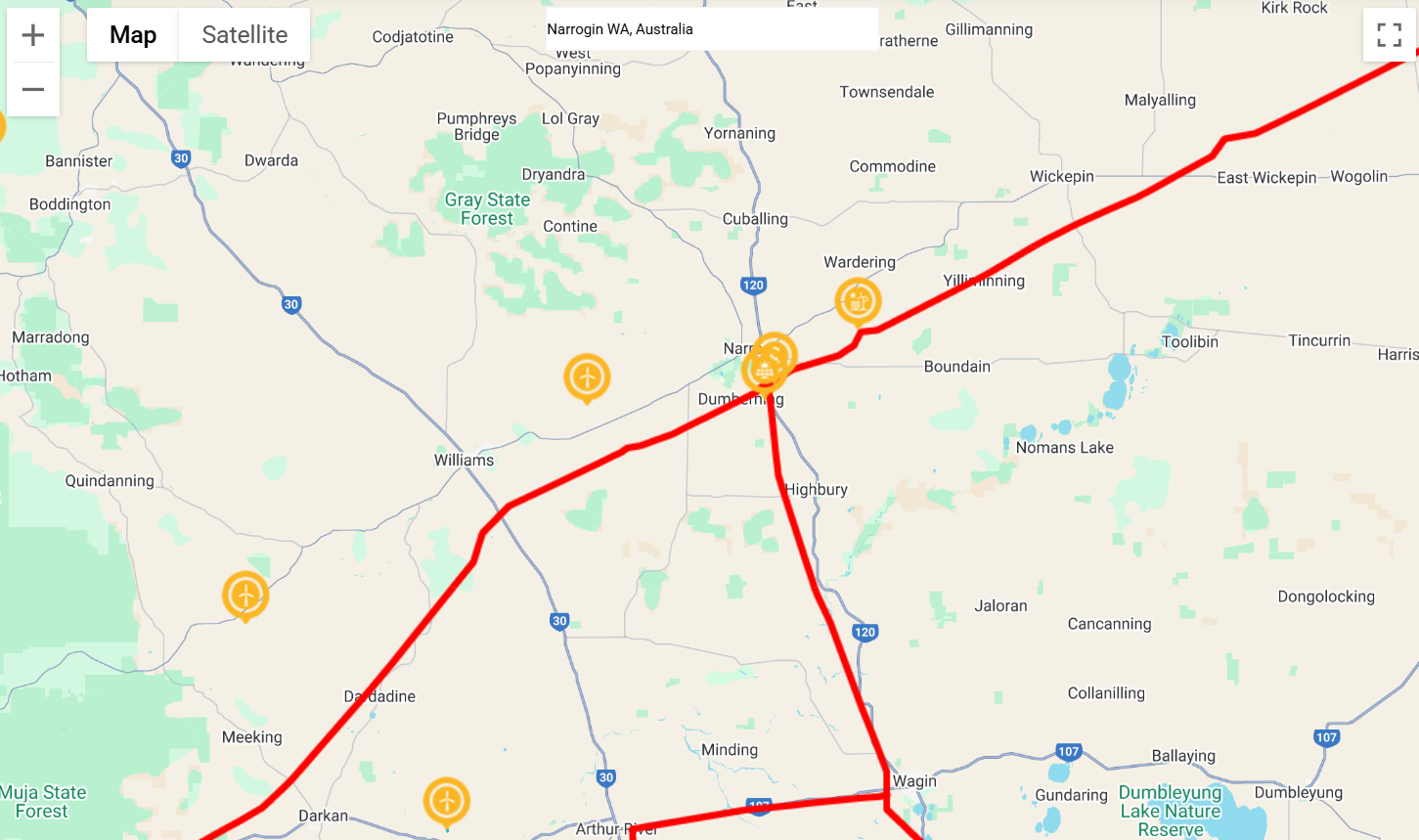

“Renewable energy must not pass through Narrogin; it must grow with it”

Published Date: 2025-April-4, Friday

Narrogin, in WA’s south-east Wheatbelt region, can be

considered a typical rural Australian town, built on the back of agriculture

and not used to . . .

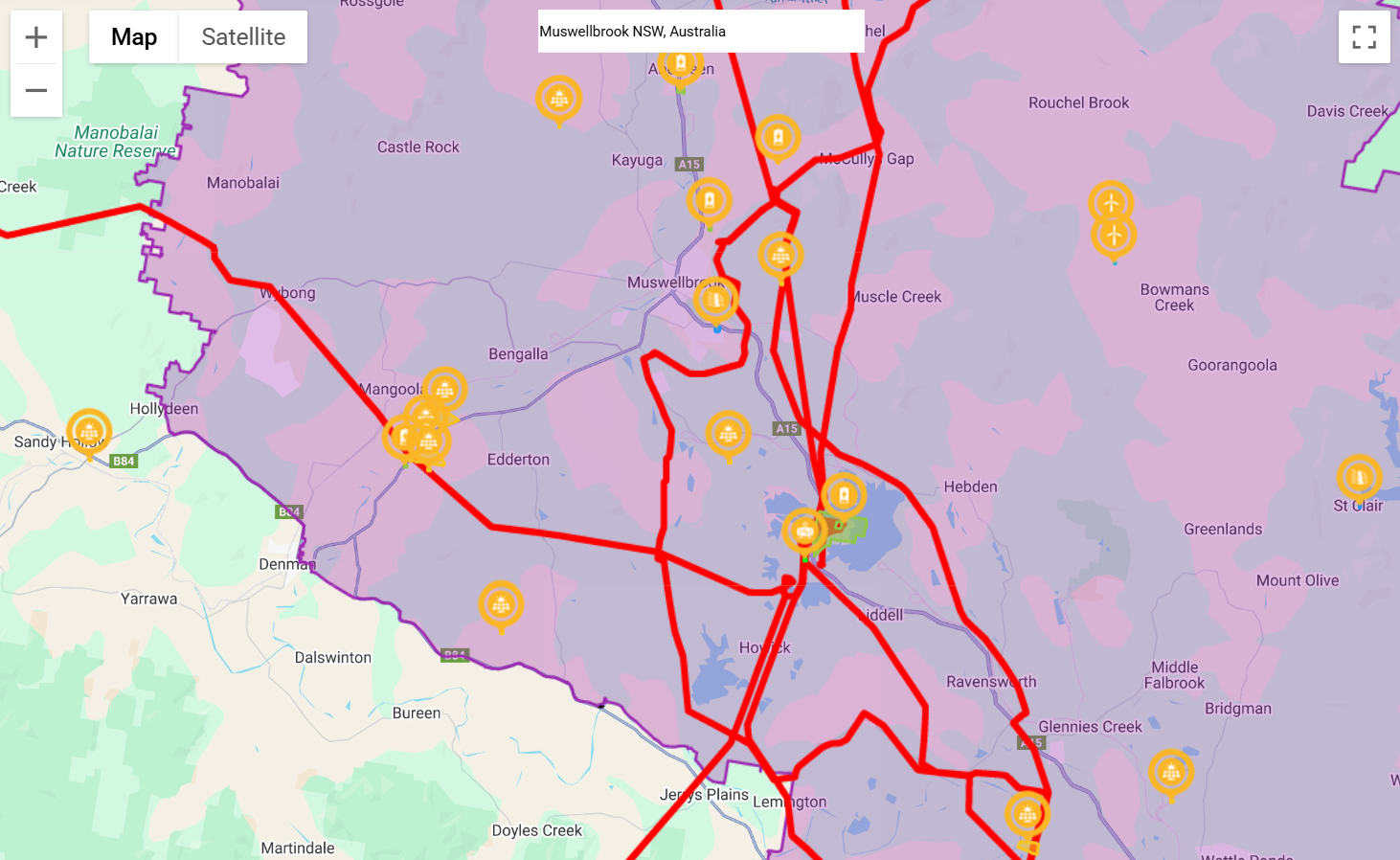

BW ESS adds another big NSW battery to its development project list

Published Date: 2025-April-3, Thursday

BW ESS builds its Australian big battery presence with plans

for a 400 MW / 1600 MWh BESS and associated infrastructure at McCullys Gap,

approximate . . .

Forrest behind two very different projects on either side of the country

Published Date: 2025-March-28, Friday

Two projects using different technologies on opposite sides

of Australia in vastly different landscapes but linked by one person, Mr Andrew

Forrest, . . .

Landowners attracting renewable energy projects to their properties

Published Date: 2025-March-11, Tuesday

In further evidence

landowners are becoming more active in securing renewable energy projects for

their properties, owners of the Lyndley Station in . . .

Avenis Energy joining in the big battery party

Published Date: 2025-March-5, Wednesday

Sydney-based Avenis Energy is joining in the big battery

party with plans for four lithium-ion battery energy storage system projects in

Victoria an . . .

WA’s Wheatbelt becoming a wind farm belt – part 2

Published Date: 2025-February-25, Tuesday

New big wind farm

projects planned in southern WA reminded us of our headline from July last year,

“WA’s Wheatbelt becoming a wind farm belt”, . . .

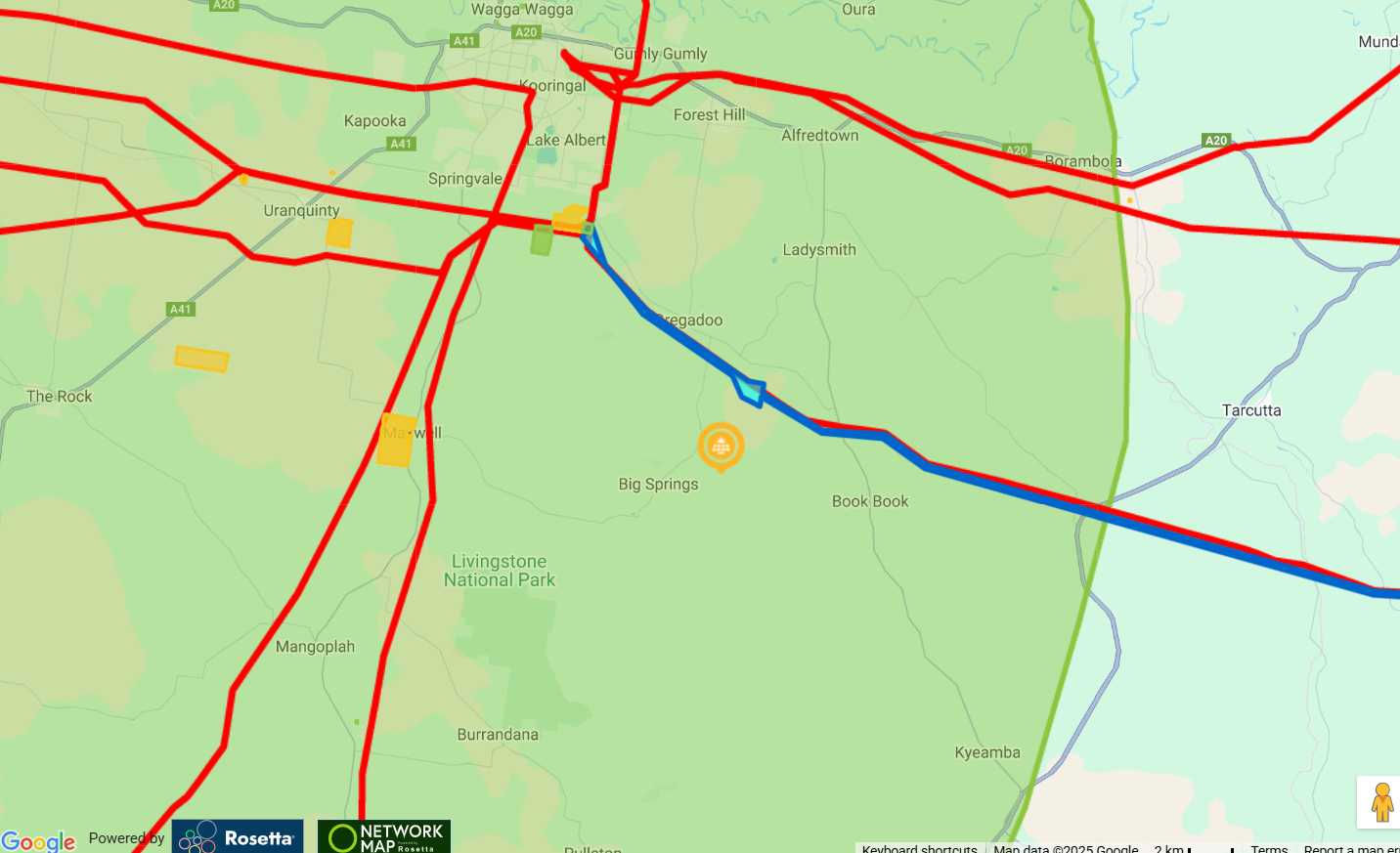

Turning a potential negative into a positive; landowner plans Livingstone Solar Farm

Published Date: 2025-February-20, Thursday

· An example of an enterprising New South Wales landowner turning what could be potentially a negative situation into some positive energy Face . . .

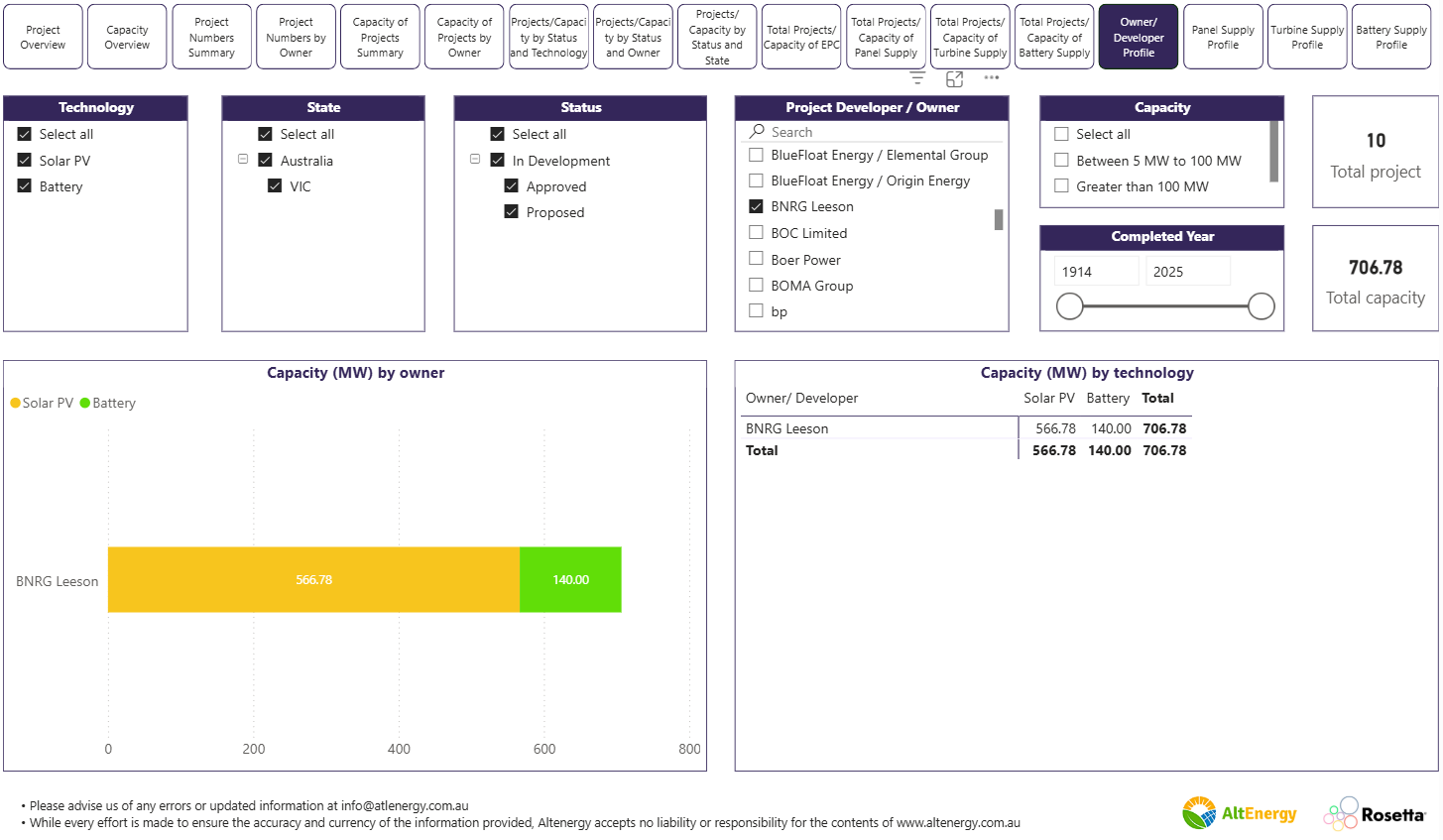

BNRG Leeson builds its solar and BESS development capacity, with Victoria the focus

Published Date: 2025-February-12, Wednesday

BNRG Leeson adds

standalone battery energy storage system projects to its development portfolio,

making plans for the Leongatha BESS and Cairnbrook . . .

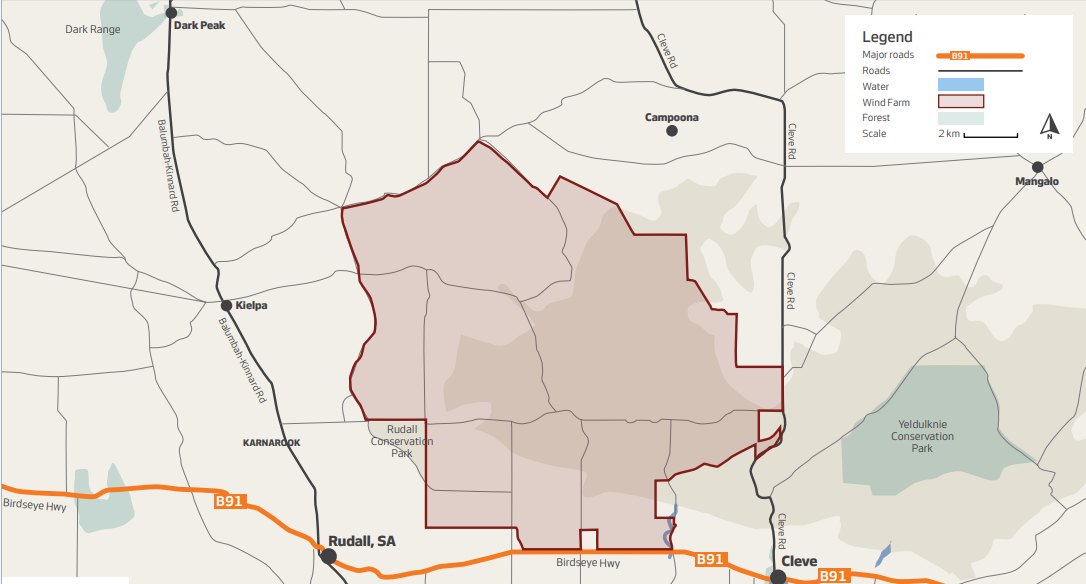

New masts to monitor at Eyre Peninsula mega-projects

Published Date: 2025-February-5, Wednesday

Amp Energy has

applied for approvals to install up to three meteorological monitoring masts near

Cape Hardy and Ungarra in support of its proposed C . . .

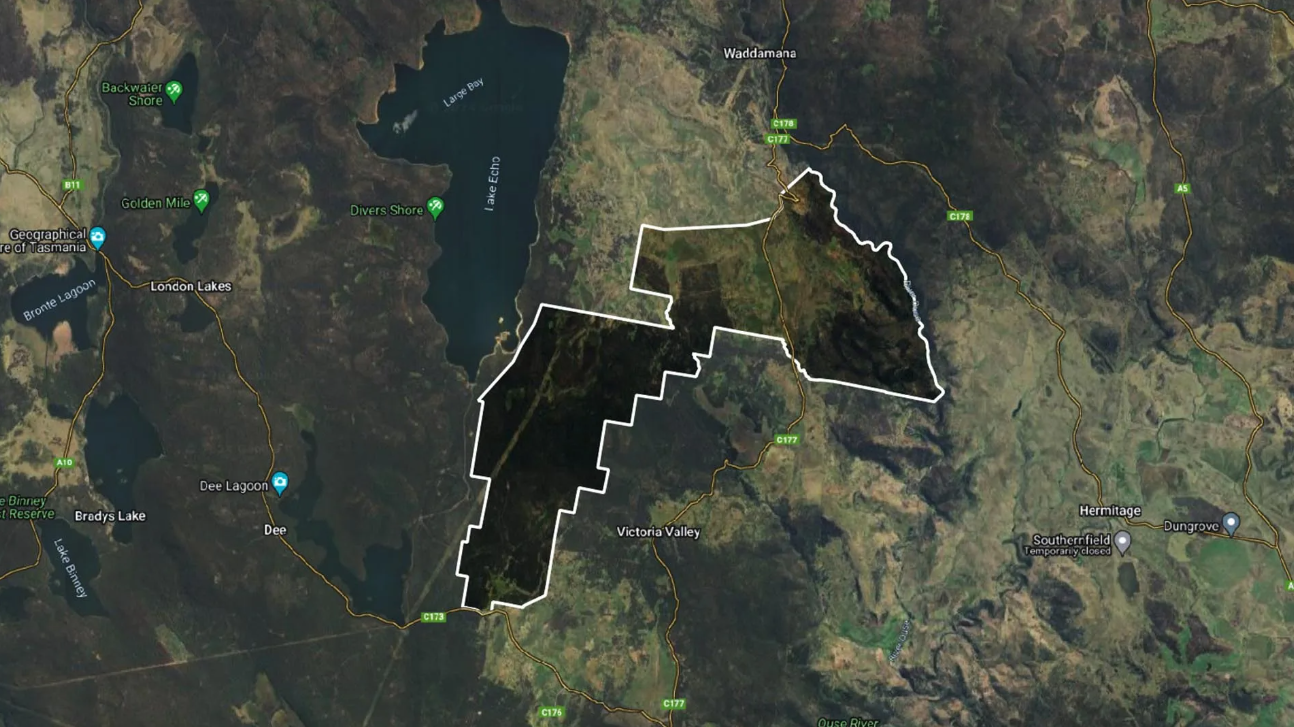

Goldwind Australia planning new Tasmanian wind farm, with eagles in mind

Published Date: 2025-January-30, Thursday

China’s Goldwind has put forward plans for its proposed up

to 450 MW Bashan Wind Farm, to be located in

Victoria Valley in Tasmania’s Central Hi . . .

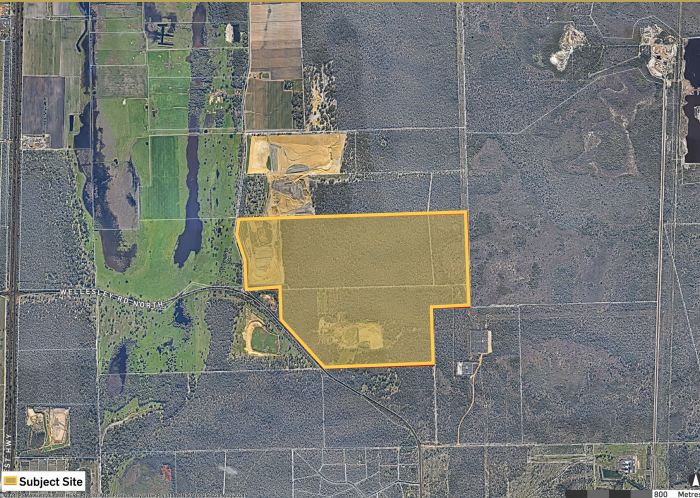

Trina Solar lining up its third BESS project

Published Date: 2025-January-27, Monday

Trina Solar has submitted a development application for its

proposed Kemerton Battery Energy Storage System in Wellesley, 15km south-west

of Harvey . . .

Metlen’s Denman BESS would put the “Super Battery” in the shade

Published Date: 2025-January-27, Monday

Metlen Energy & Metals is proposing a massive battery

energy storage system to be located approximately 7.7km north-east of Denman

and 16.7km so . . .

AGL planning its first Queensland big battery

Published Date: 2025-January-27, Monday

AGL Energy has added a Queensland battery project to its

development queue, submitting a development approval application with the

Western Downs Reg . . .

SEI and YES Group start 2025 with a bang

Published Date: 2025-January-15, Wednesday

Sustainable Energy Infrastructure (SEI) continues its rapid

pace of solar farm construction into 2025 with two new projects underway in NSW,

the Mul . . .

Showdown looming at Meadow Creek

Published Date: 2024-November-28, Thursday

A planning permit application has been

lodged with the Victorian Department of Transport and Planning that is certain

to ruffle a few feathers.

. . .

Competition for prime substation locales heating up

Published Date: 2024-November-28, Thursday

Increasing competition for utility-scale battery energy

storage system development sites has been clearly revealed this week with two separate,

neig . . .

New renewables project developer starts its voyage

Published Date: 2024-November-8, Friday

A new Australian project developer, Voyager Renewables, has been

launched with the backing of multi-national fund manager Copenhagen

Infrastructure . . .

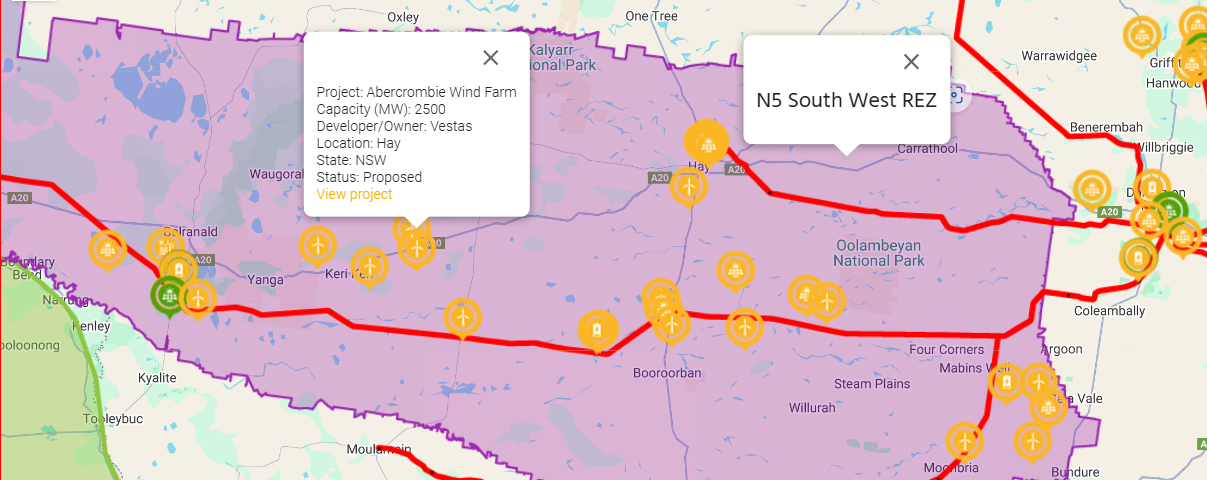

Vestas planning its third & biggest Australian wind farm project

Published Date: 2024-October-31, Thursday

Danish wind turbine giant Vestas is looking

to consolidate its position in the Australian upstream renewable energy industry

by making plans to deve . . .

Vestas looking to “squeeze in” a 2500 MW wind farm in NSW’s SW REZ

Published Date: 2024-October-31, Thursday

Vestas has joined the project queue in a busy part of the NSW

NEM and has not been shy about the size of its proposal, submitting a Scoping

Report f . . .

Missing the energy transition boat again

Published Date: 2024-October-27, Sunday

There was one glaring omission in the energy policy announcements made by the Australian federal government this month. Released in two tranches, the . . .

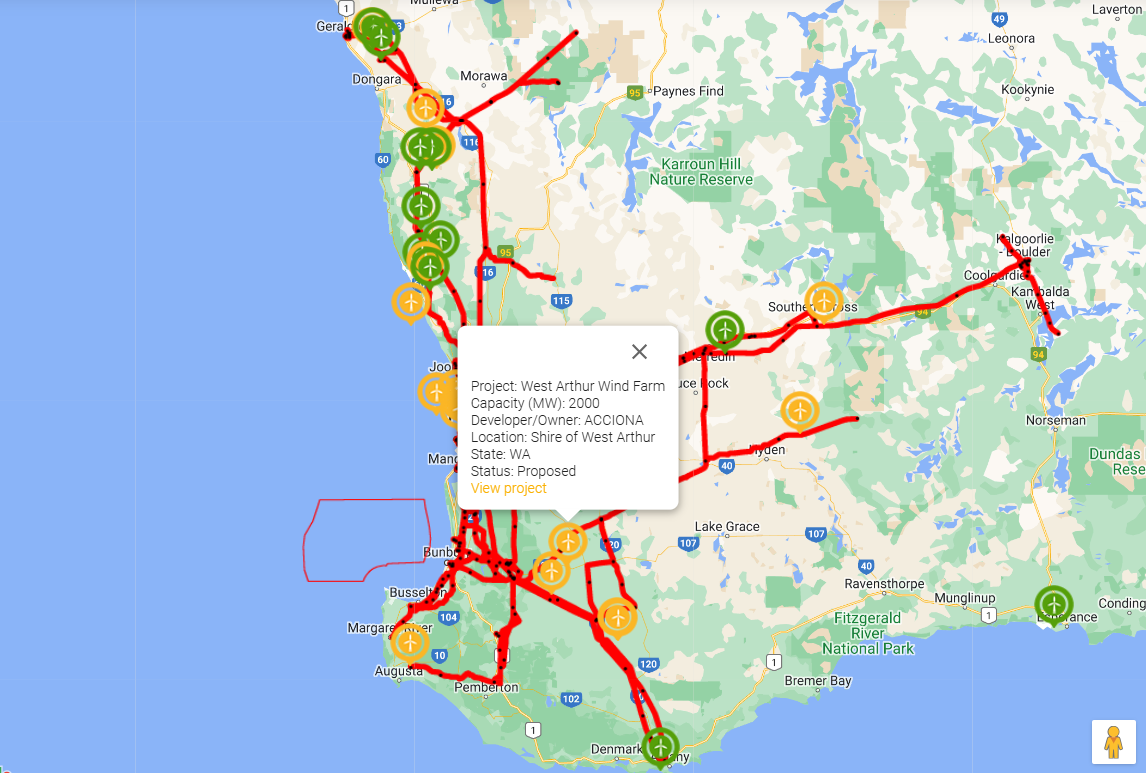

WA’s Wheatbelt becoming a wind farm belt

Published Date: 2024-October-25, Friday

ACCIONA Energia

has reported positive results so far from wind monitoring at its Shire of West Arthur site, located in the Wheatbelt region of

WA, w . . .

Renewable energy potential boosting land prices

Published Date: 2024-October-25, Friday

Over the years there has been terabytes of social media

posts and comments, occasionally breaking through into the mainstream media,

about how large . . .

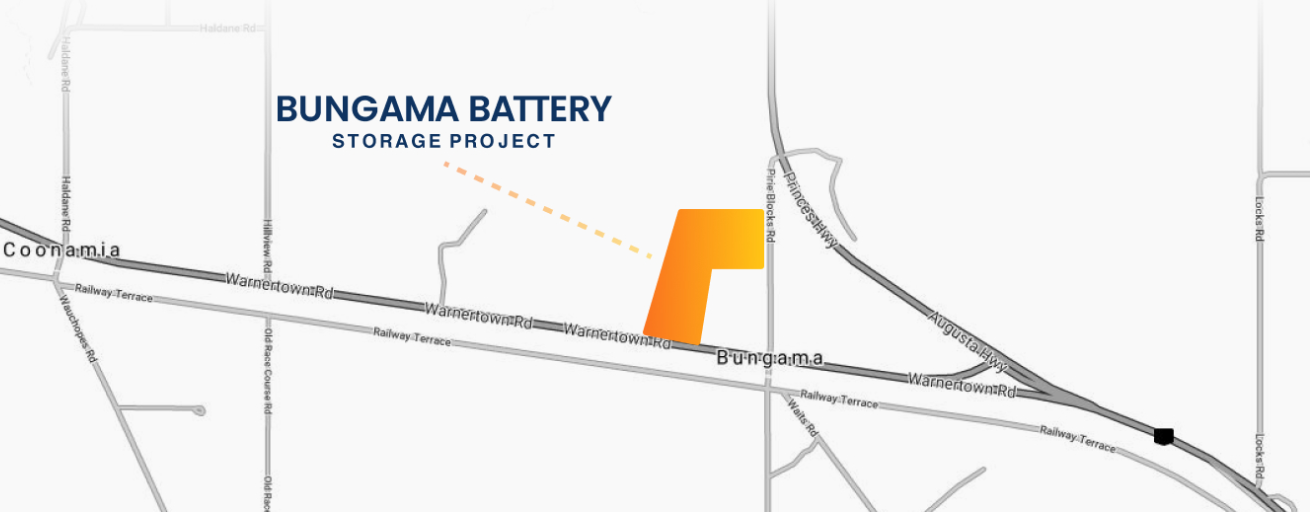

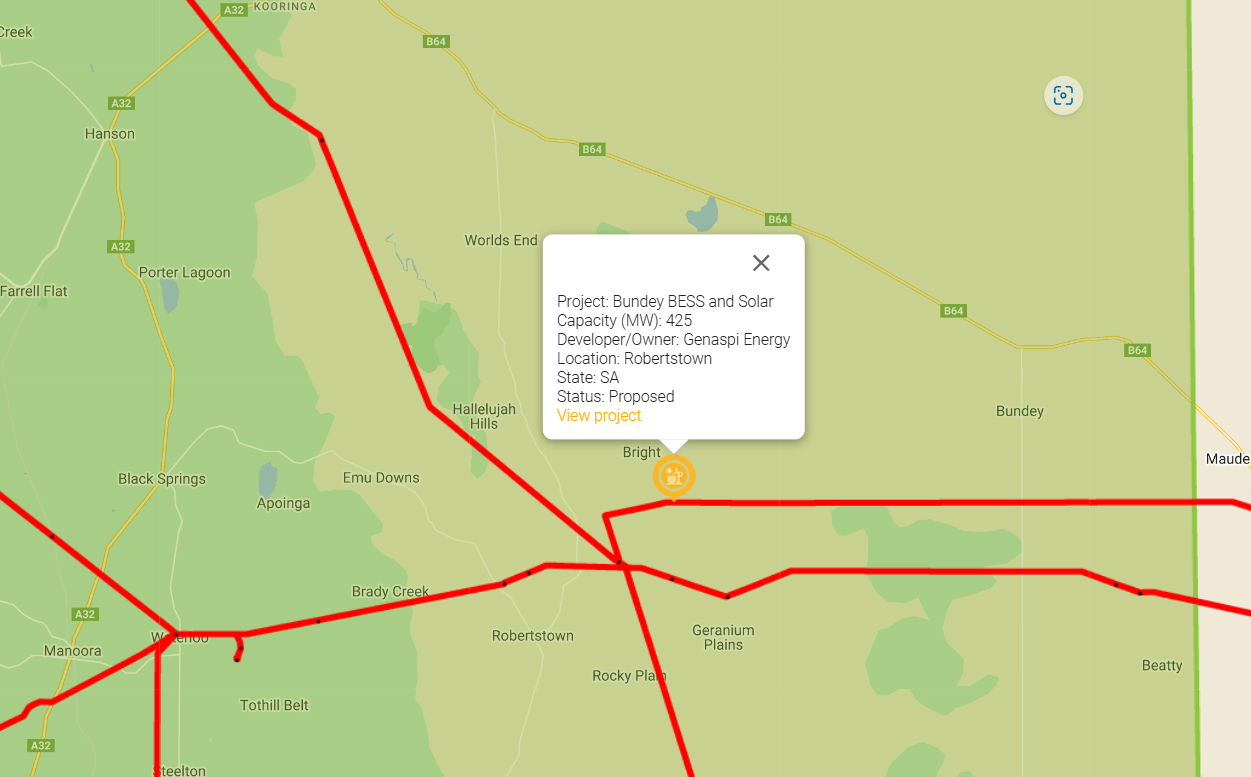

After a pause, SA planners receive burst of new development applications

Published Date: 2024-October-2, Wednesday

New large-scale

renewable energy project development proposals in South Australia have been

relatively quiet of late as successful applications from . . .

Yancoal’s Stratford Renewable Energy Hub takes forward planning step

Published Date: 2024-October-2, Wednesday

Yancoal Australia’s proposed Stratford Renewable Energy Hub

(SREH), to be located in the Gloucester Valley approximately 95km north of

Newcastle i . . .

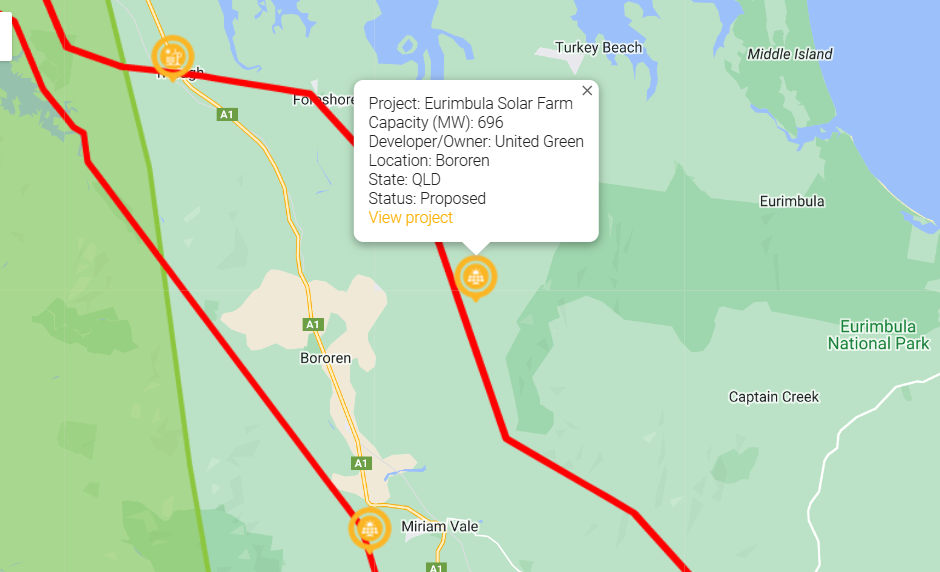

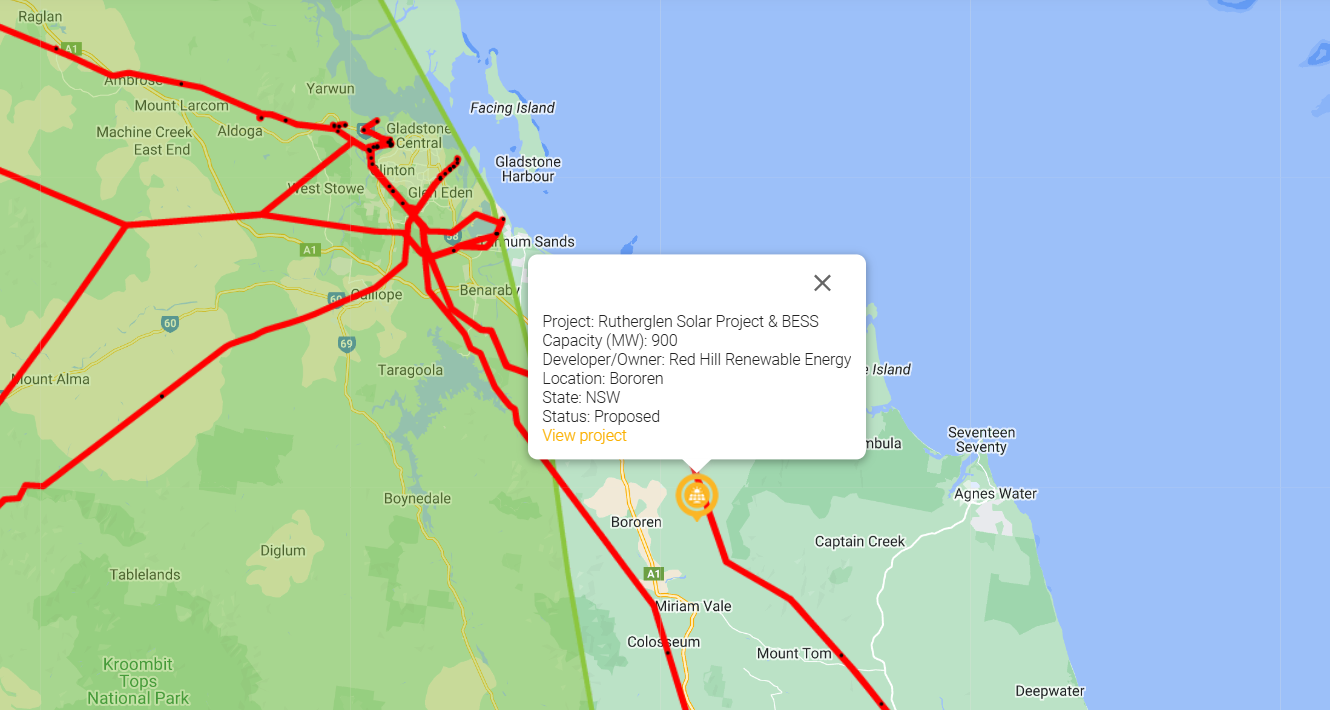

New developer Red Hill pegs possibility of lower-cost mounting for 900 MW solar farm

Published Date: 2024-September-27, Friday

Brisbane-based

Red Hill Renewable Energy has put forward its first project proposal, a 900 MW

DC solar farm and BESS near Bororen in the Gladstone R . . .

Moonlight attracts Brookfield to Greenleaf

Published Date: 2024-September-24, Tuesday

Last week Australian wind farm project developer Greenleaf

Renewables announced a partnership with renewable energy arm of Canadian

investment giant . . .

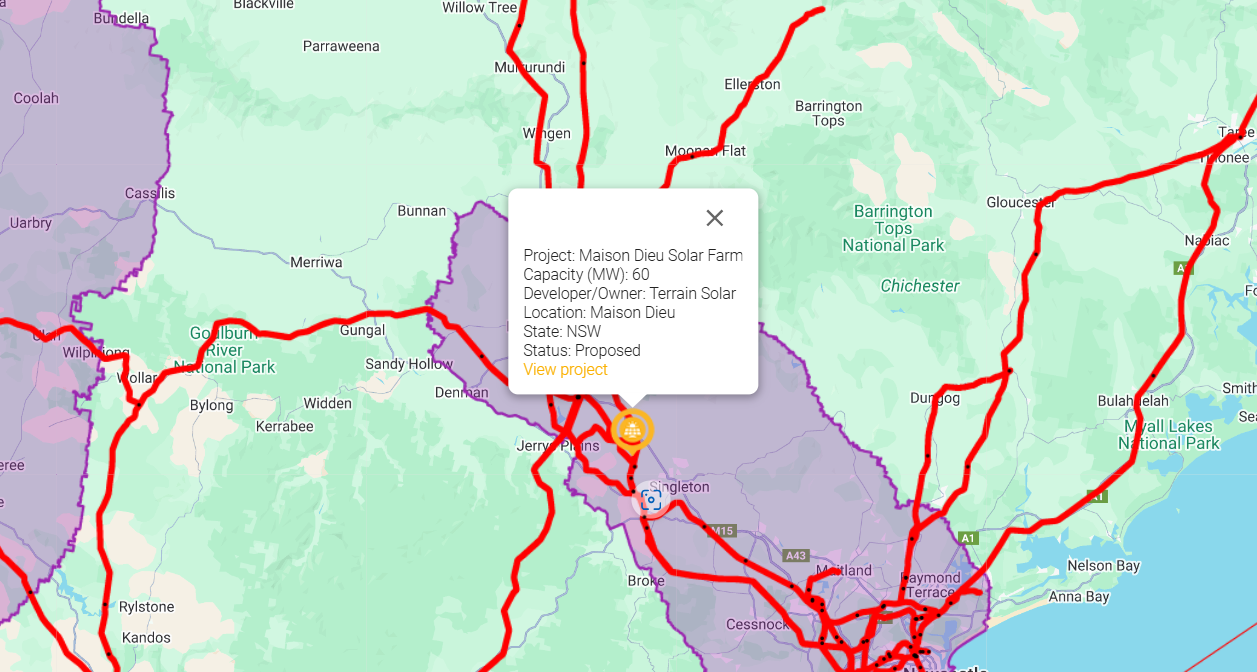

PROJECT UPDATE: Maison Dieu Solar Farm, NSW

Published Date: 2024-September-13, Friday

The exhibition period for Terrain Solar’s Maison Dieu Solar Farm, to be located on a site approximately

10km north-west of Singleton within the Hun . . .

DP Energy gets new wind farm neighbours in Euston, NSW

Published Date: 2024-August-22, Thursday

Squadron

Energy is not mucking around with its renewable energy ambitions, with planning

underway for a massive, up to 2 GW project near Euston in N . . .

Rodds Bay re-emerges bigger and with a different name

Published Date: 2024-August-8, Thursday

Two

projects located close together in the Gladstone Regional Council in Queensland

have been opened for public comment under the EPBC Act by the fe . . .

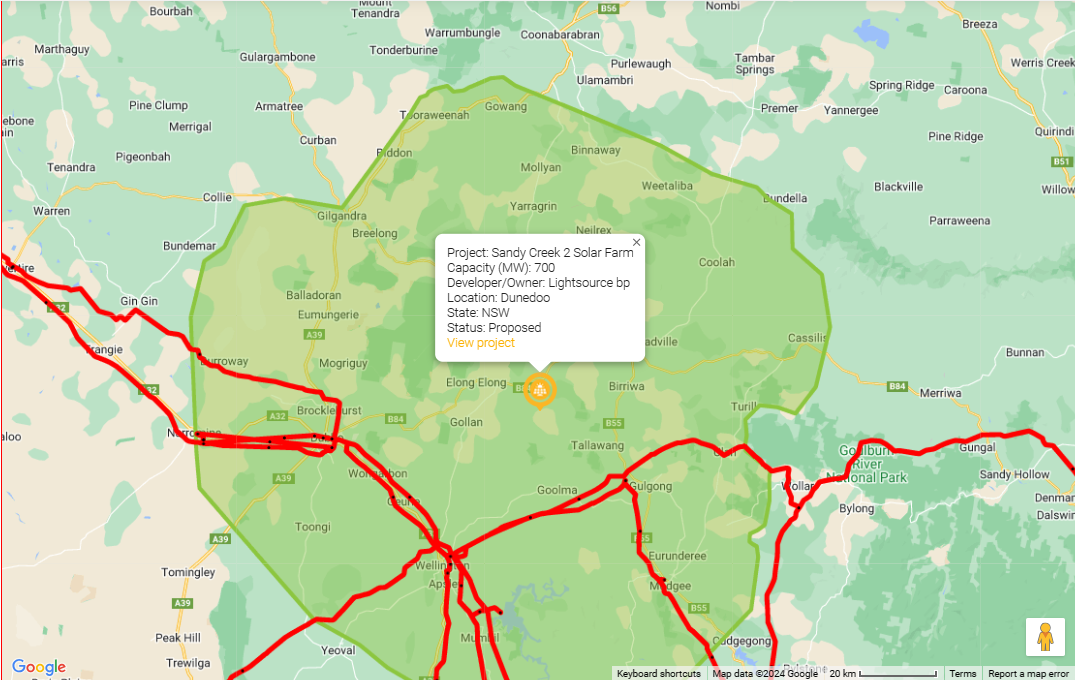

PROJECT UPDATE – Sandy Creek Solar Farm approved

Published Date: 2024-July-11, Thursday

Lightsource bp’s Sandy Creek Solar

Farm, located 25km south-west of Dunedoo in NSW's Central West, was

declared a non-controlled action by the DCC . . .

Pumped hydro suddenly running hot

Published Date: 2024-July-3, Wednesday

BE Power launched its second Queensland pumped hydro

project, called Big-G, to be located at Mount Alma, approximately 55km from

Gladstone.

The . . .

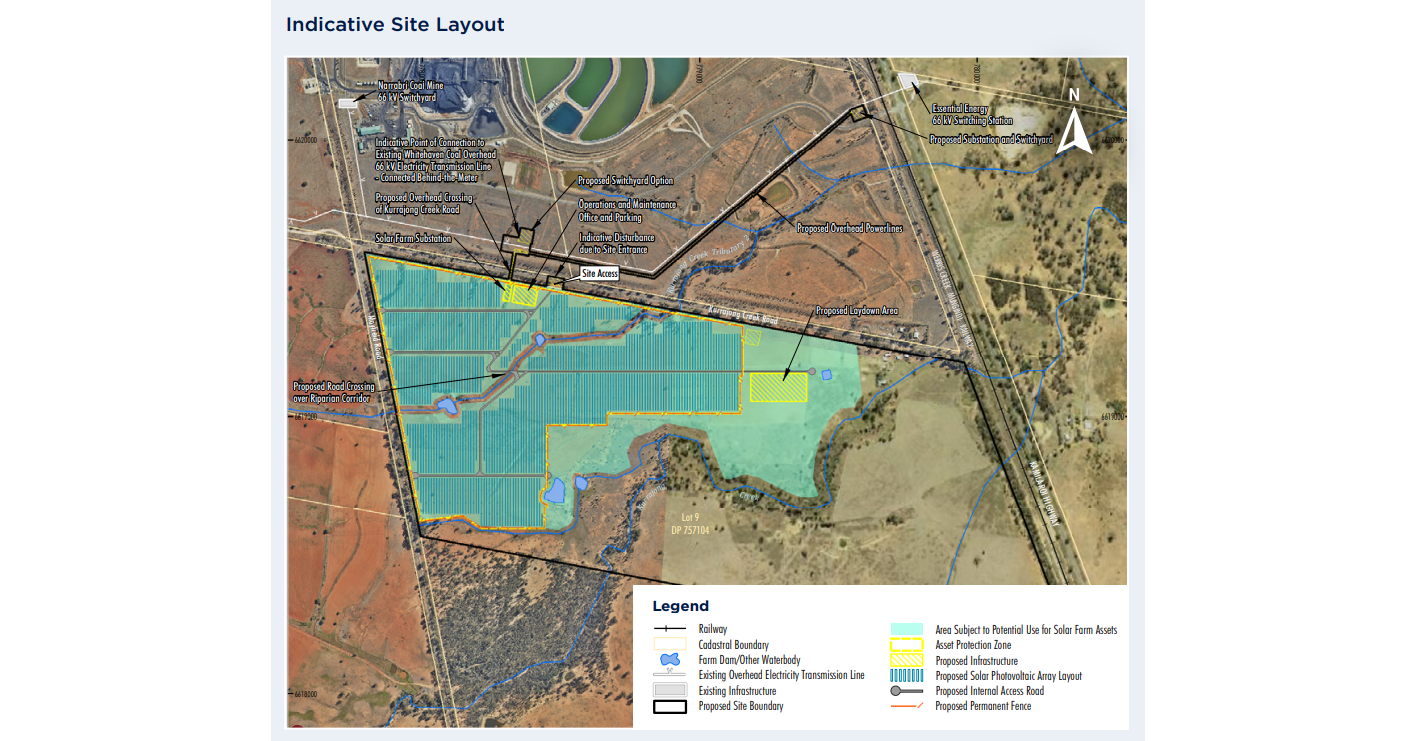

Coal miners planning to add renewables

Published Date: 2024-May-2, Thursday

Plans have been released for two new large-scale renewable

energy projects in New South Wales on land associated with coal mining.

Whitehaven Ene . . .

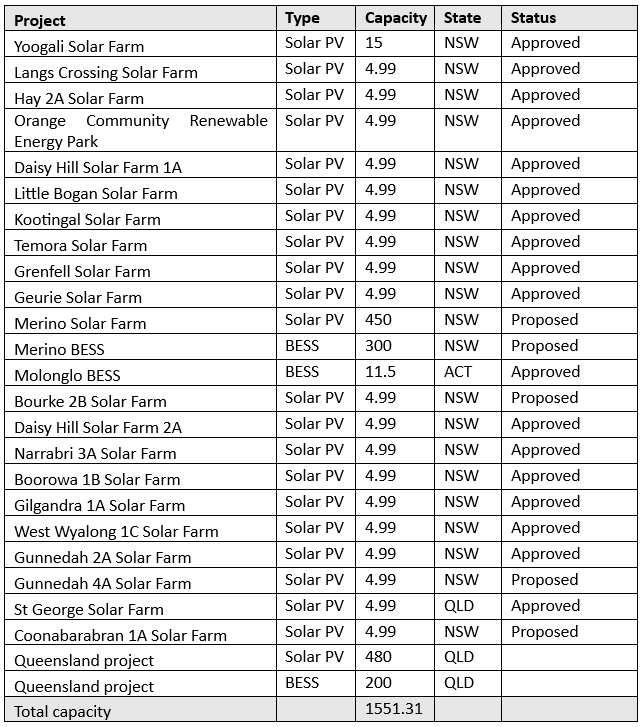

EDP Renewables takes over large Aussie project book

Published Date: 2024-May-2, Thursday

EDP Renewables has hit the ground running after acquiring

ITP Development with its extensive Australian project book (see the project

table below as . . .

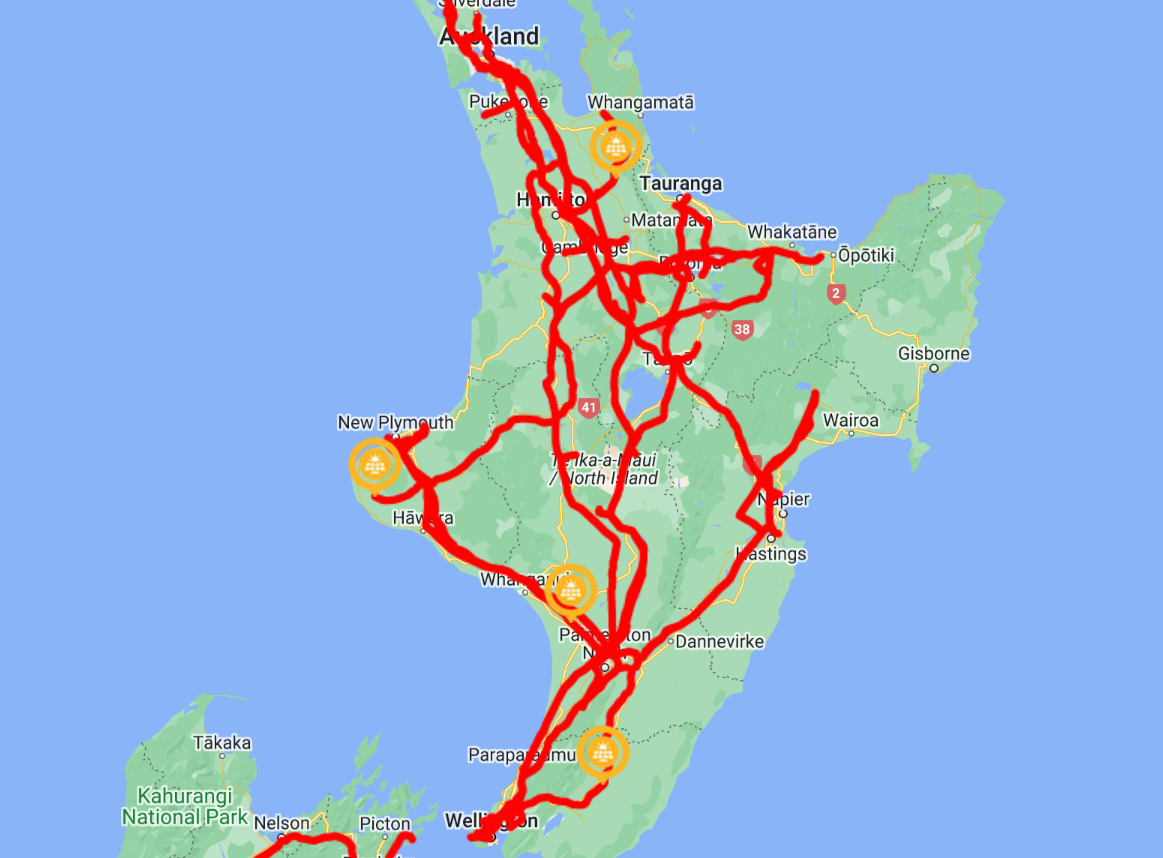

PROFILE: Bison Energy expanding into New Zealand

Published Date: 2024-April-30, Tuesday

Japan-headquartered, international renewable energy project

developer, investor and EPC company Bison Energy has quietly built up a

portfolio of sol . . .

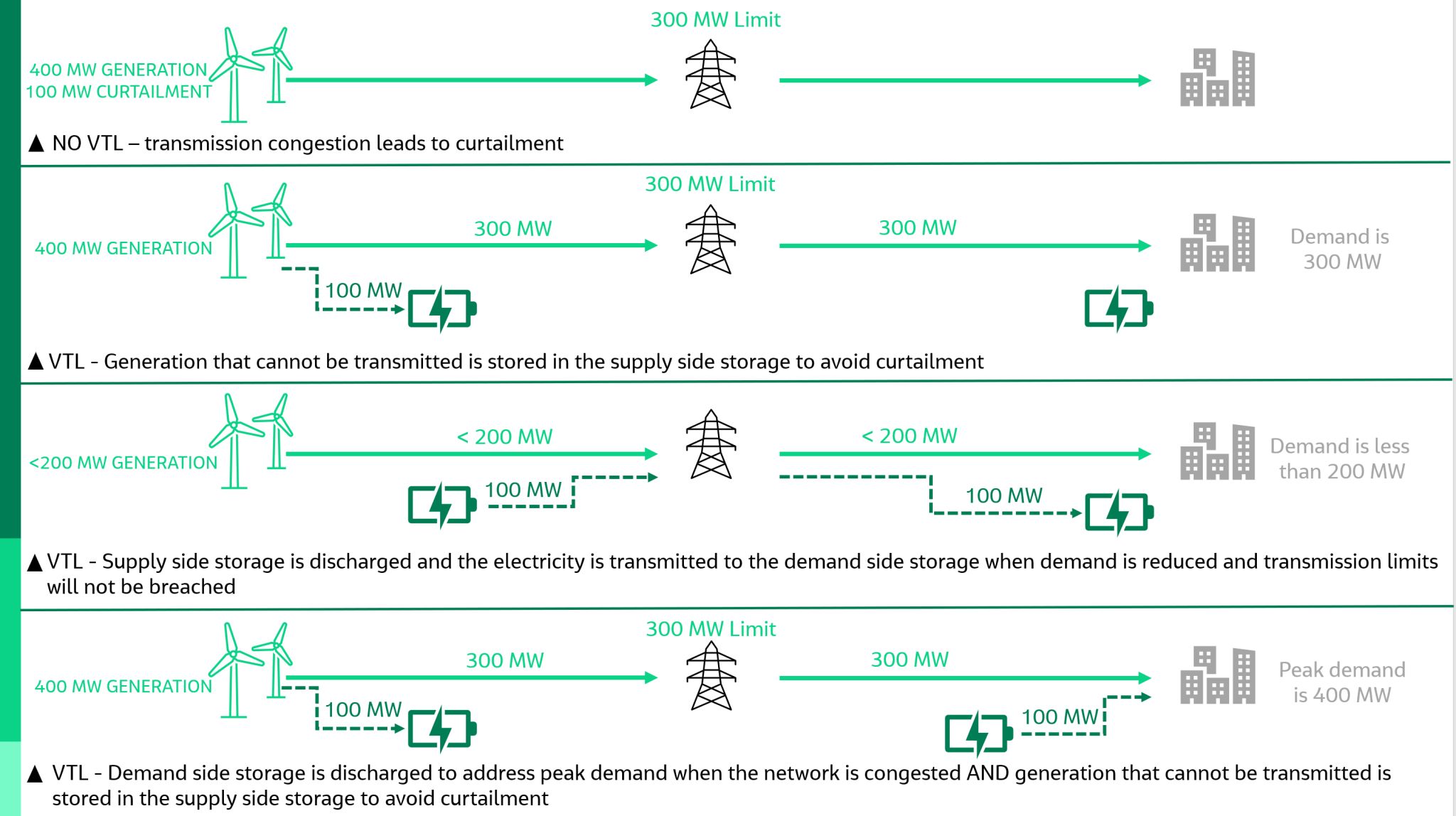

Another tool for big battery “Swiss army knives”

Published Date: 2024-April-30, Tuesday

No doubt about it, electricity transmission is a hot topic

in Australian energy circles at the moment. It’s abundantly clear that

Australia will n . . .

Risen powers up its BESS project pipeline

Published Date: 2024-April-30, Tuesday

Risen Energy’s Coleambally BESS project,

a 100 MW / 400 MWh battery energy storage system to be located approximately 9km

north-east of Coleambal . . .

Plans released for The Plains Solar Farm

Published Date: 2024-April-30, Tuesday

ENGIE ANZ has released plans for its proposed The Plains

Solar Farm, located 33km south of Hay in the Riverina Murray region of NSW.

The project . . .

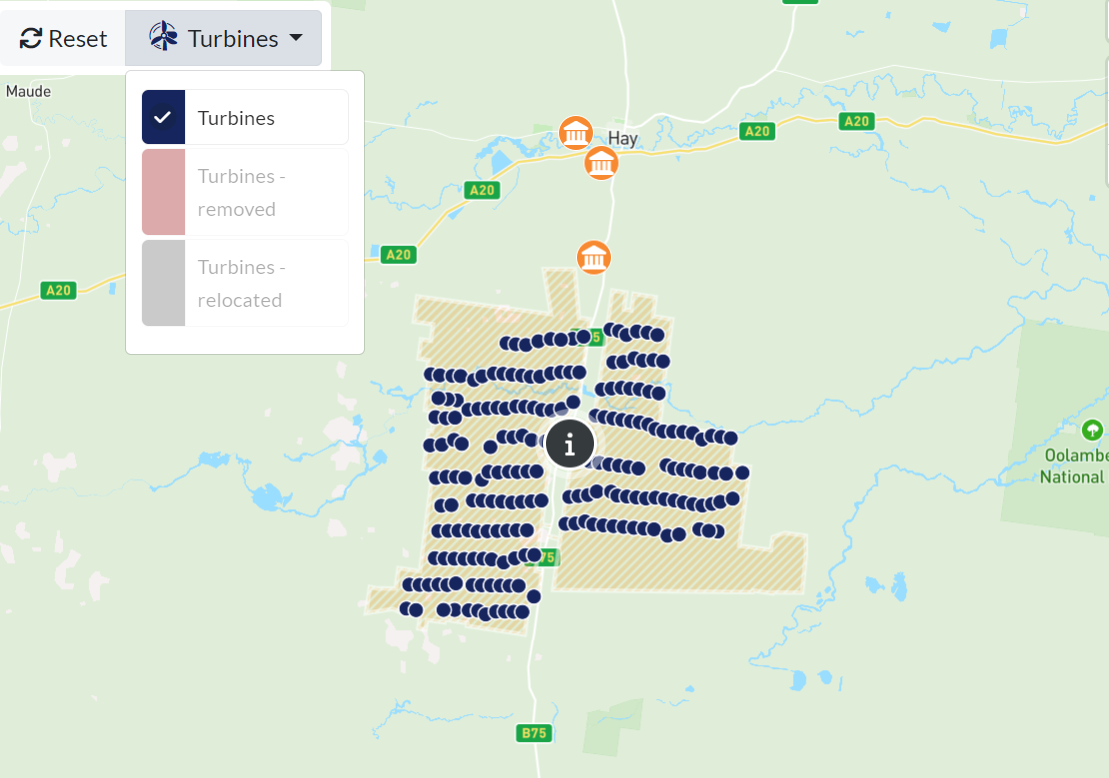

Proposed solar farms under scrutiny by NSW IPC

Published Date: 2024-April-30, Tuesday

Two new proposed solar farms in NSW

have been put under the microscope by the NSW Independent Planning Commission (IPC)

due to the high number of su . . .

GameChange Solar to team up with Bison Energy in Australia

Published Date: 2024-April-30, Tuesday

Solar tracker and fixed tilt racking technology supplier GameChange

Solar signed a MOU with solar farm developer Bison Energy for the two companies

. . .

PROFILE Dennis Freedman, Aquila Clean Energy APAC

Published Date: 2024-April-30, Tuesday

Aquila Clean Energy APAC appointed industry veteran Dennis

Freedman as Managing Director, Head of Australia & New Zealand, to lead

operations an . . .

PROFILE: Rachel Watson – OX2 Australia County Manager

Published Date: 2024-April-23, Tuesday

It’s been

almost 12 months since Sweden-headquartered OX2 made its first acquisition

outside Europe, buying Australian renewables developer ESCO P . . .

Vena fine tuning its Bellambi Heights BESS plans

Published Date: 2024-March-15, Friday

Vena Energy has further refined its Bellambi Heights Renewable Project making several significant modifications to its proposal, which will now become . . .

Is the BESS boom contributing to a wind and solar farm slowdown?

Published Date: 2023-November-8, Wednesday

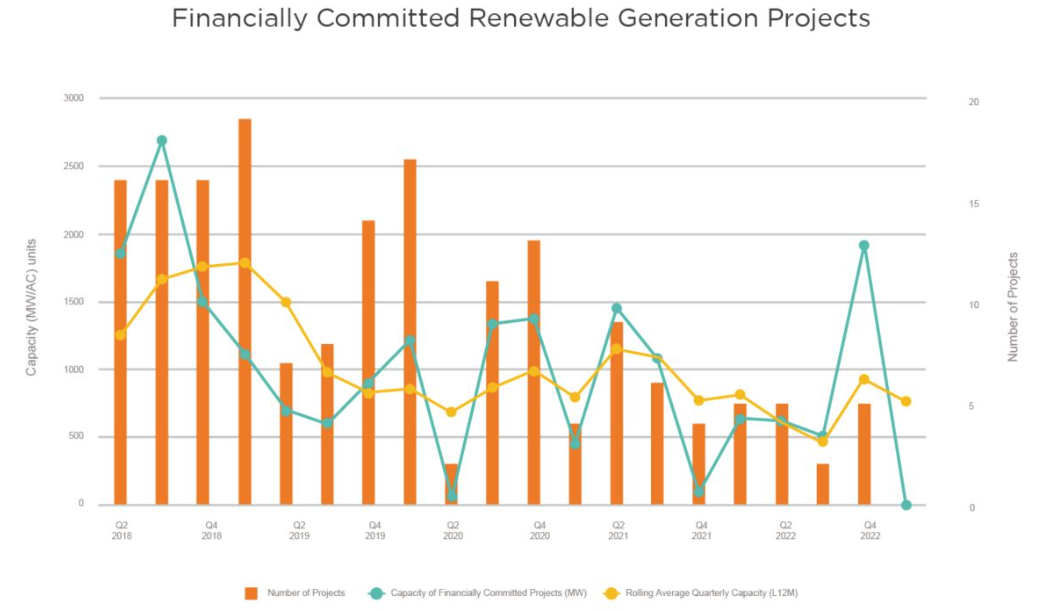

The Clean Energy Council (CEC) recently produced some

alarming statistics regarding the lack of investment in large-scale renewable

energy projects . . .

Preconstruction kicks off at Munna Creek Solar Farm

Published Date: 2023-October-19, Thursday

Multi-national renewable energy developer Mytilineos has

acquired the 120 MW Munna Creek Solar Farm project, 40km north-west of Gympie

in Queensland . . .

Harmony Energy seeking consents for three NZ solar farms

Published Date: 2023-October-13, Friday

UK-based Harmony Energy has applied for fast-track resource

consents from the NZ Government for three solar farms that would add a total of

almost 3 . . .

Iberdrola advances plans for Sydney big battery

Published Date: 2023-September-28, Thursday

Iberdrola Australia is another major Australian renewable energy project developer pushing ahead with plans for big battery projects, seeking approval . . .

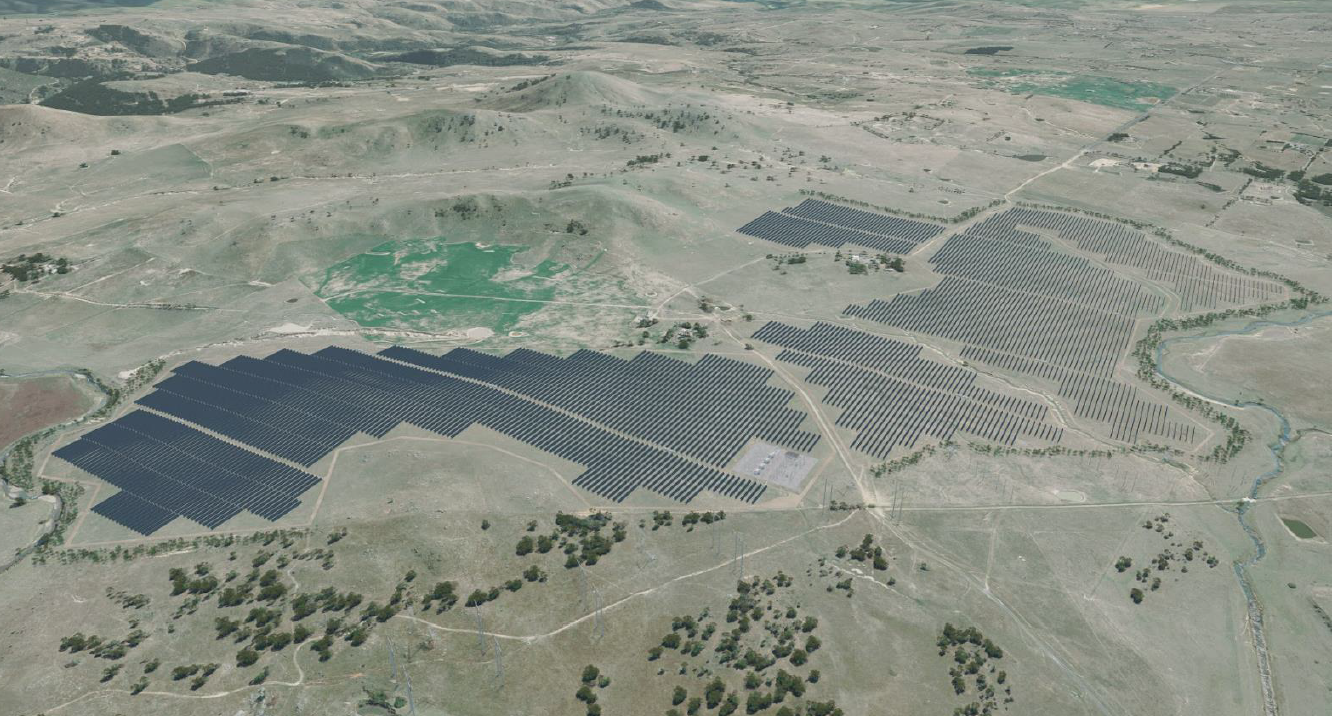

Wallaroo Solar Farm takes a big jump forward

Published Date: 2023-August-21, Monday

A couple of lesser-known companies in the Australian solar

farm development industry have reached a major milestone for their Wallaroo

Solar Farm pr . . .

Another Collie battery gets a boost with land deal

Published Date: 2023-August-14, Monday

ZEN Energy’s long-held plans for a big

battery in Collie, south-west WA, have been given a boost courtesy of a land deal

by a partner. Internation . . .

Vena expanding its Tailem Bend project with new battery

Published Date: 2023-July-24, Monday

Vena Energy plans to continue expanding its Tailem Bend

project in South Australia by adding a second, much larger battery energy

storage system of . . .

EPC contractors picked for Port Hedland hybrid project

Published Date: 2023-July-19, Wednesday

Alinta Energy has selected EPC contractors for its Port

Hedland Solar Battery Hybrid project which will see an initial 45 MW AC solar

farm and 30 MW . . .

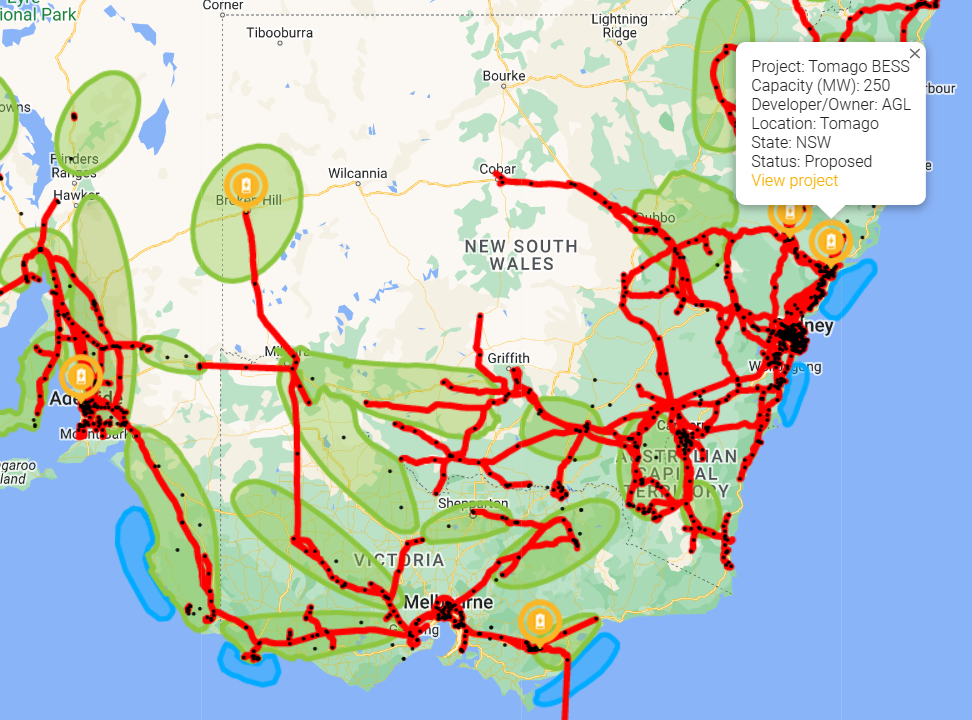

Will a big battery replace an unbuilt gas peaker?

Published Date: 2023-July-13, Thursday

AGL Energy has submitted plans for a new 500 MW / 2000 MWh battery energy storage system in Tomago, near Newcastle in NSW, to the state planning autho . . .

IKEA adds more Aussie renewable energy capacity to its shelves

Published Date: 2023-June-30, Friday

Ingka Group, owner of the iconic IKEA

Retail business, has increased its Australian renewable energy capacity by acquiring

a 195 MW DC solar PV port . . .

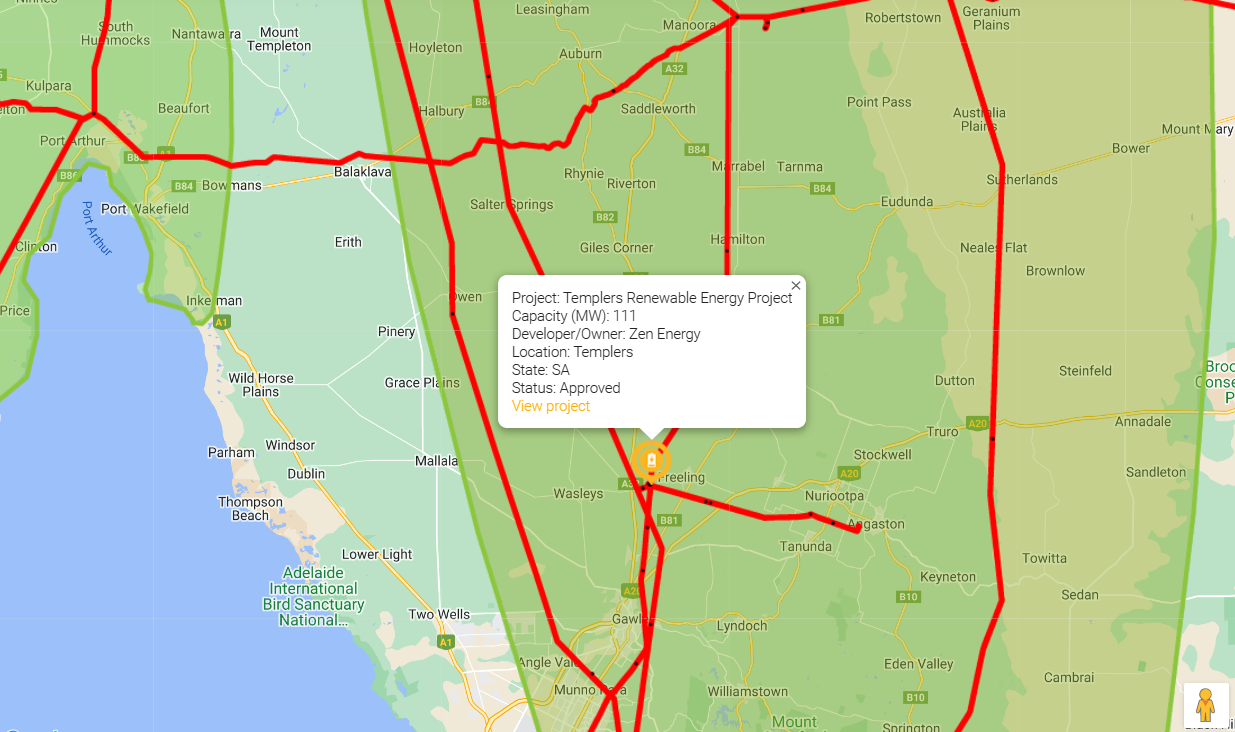

ZEN builds on PPAs with project ownership

Published Date: 2023-June-22, Thursday

After concluding a number of PPA

deals over the last several months, ZEN Energy has jumped into the direct

project ownership ring by acquiring the T . . .

Three massive wind farm projects to be assessed by federal government

Published Date: 2023-May-25, Thursday

Referrals for three massive wind

farms have been submitted to the federal Department of Climate Change, Energy,

the Environment & Water for asse . . .

BlueFloat Energy announces latest offshore floating wind development in the Hunter Region – ‘Eastern Rise’

Published Date: 2023-May-25, Thursday

BlueFloat Energy has announced

plans for a new floating offshore wind project. The Eastern Rise Offshore Wind

Project is the latest in BlueFloat Ene . . .

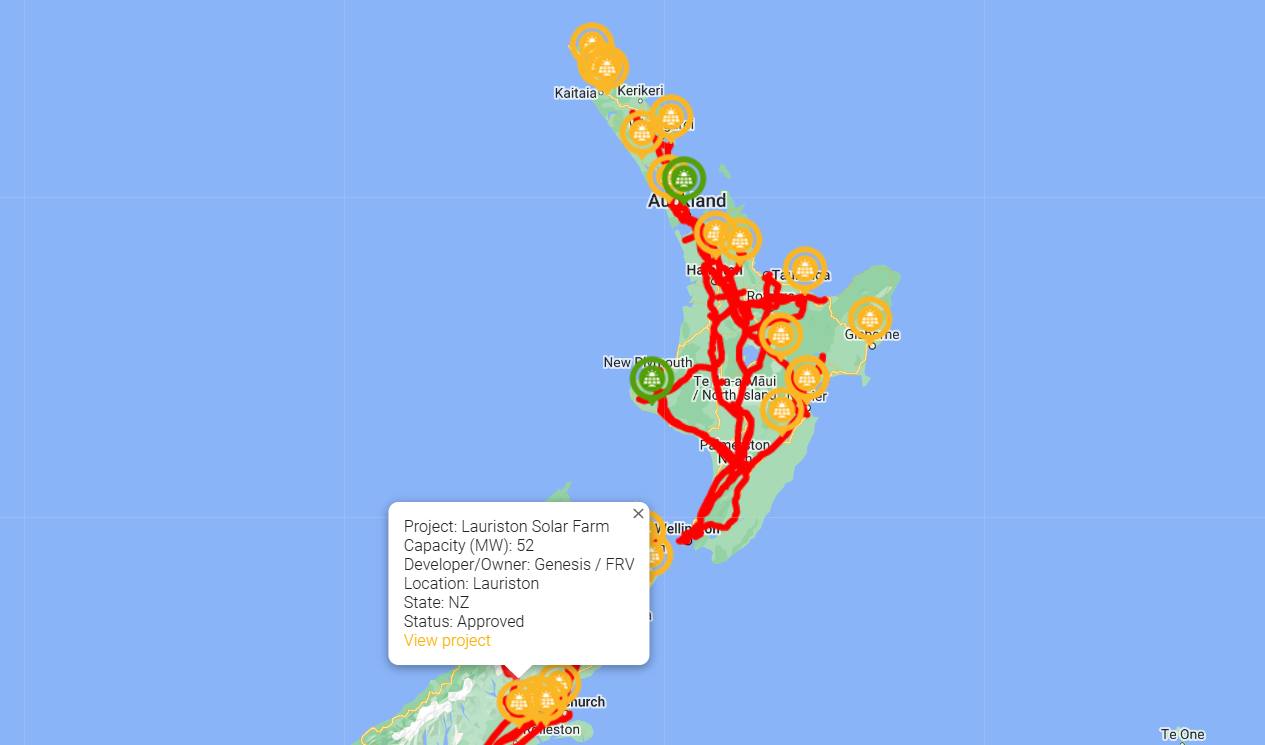

Major players to spark additional large-scale solar interest in NZ

Published Date: 2023-May-10, Wednesday

A Genesis - FRV Australia joint venture has acquired its

first New Zealand large scale solar farm project, the 52 MW Lauriston Solar Farm

located on . . .

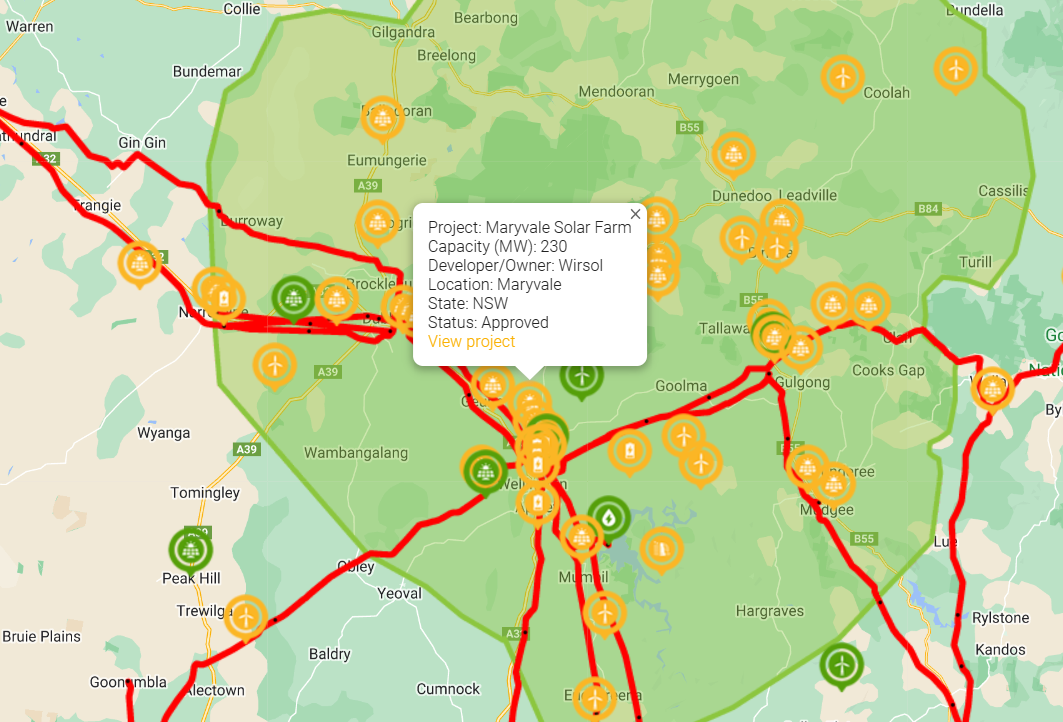

Maryvale Solar Farm could almost double in capacity

Published Date: 2023-May-2, Tuesday

Wirsol Energy is planning to almost double the capacity of

its proposed Maryvale Solar Farm, located approximately 15km north-east of

Wellington in . . .

Neoen launches construction of Blyth Battery in SA

Published Date: 2023-March-29, Wednesday

In what we expect will be the first of many new big battery announcements in 2023, Neoen has provided notice to proceed for construction of its 200 MW . . .

Ducks lining up for Wambo Wind Farm construction

Published Date: 2023-March-21, Tuesday

Although there hasn’t been an

official announcement, it appears the Wambo Wind Farm, located near the Bunya

Mountains in the Western Downs region . . .

Stage 2 of the Victorian Big Battery approved

Published Date: 2023-March-9, Thursday

Victoria’s Department of Planning and Environment has

approved stage 2 of Neoen Energy’s Victorian Big Battery (VBB2) project in

Moorabool, Vict . . .

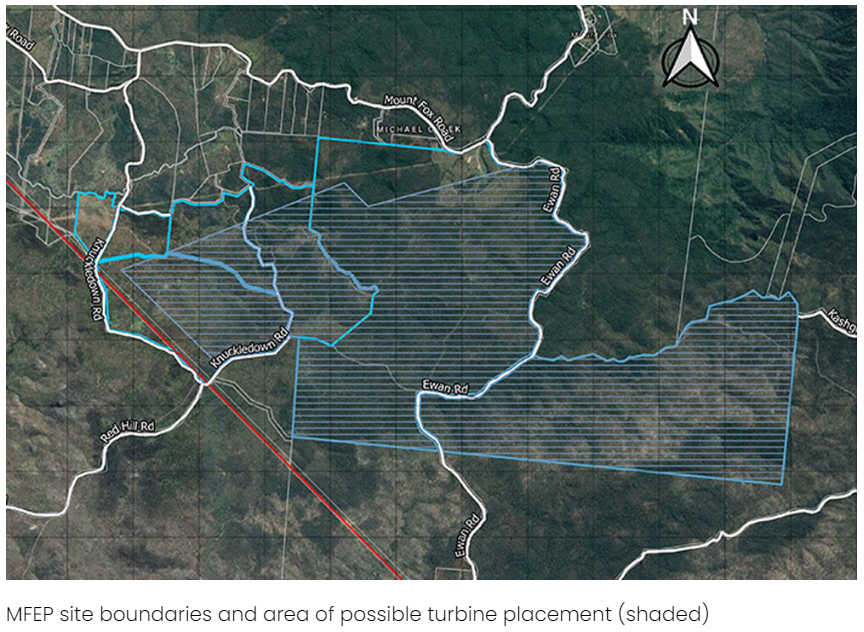

TagEnergy joins Mt Fox development team

Published Date: 2023-March-9, Thursday

International renewable energy developer TagEnergy continues

to spread its wings in Australia by joining the Mt Fox Energy Park development

team.

. . .

Voyager sails through its biggest Aussie project

Published Date: 2023-February-28, Tuesday

FTC

Solar’s 2P Voyager+ tracking system has sailed through its largest capacity

Australian project so far, the Mica Creek Solar Farm in Queensland . . .

Nextracker to go public with IPO & listing

Published Date: 2023-February-14, Tuesday

International solar tracker supply and installation company

Nextracker, a Flex Ltd subsidiary, has filed a registration statement for a

proposed ini . . .

First Aussie SolBank project for Canadian Solar

Published Date: 2023-February-7, Tuesday

Canadian

Solar is planning a new big battery at Evans Plains, 5.8km south-west of the

City of Bathurst in NSW.

The

Panorama BESS project invol . . .

Energy Vault awarded first Australian big battery project

Published Date: 2023-January-23, Monday

Energy

Vault Holdings was awarded a Notice of Award for the deployment of a 250 MW/500

MWh battery energy storage system at the proposed 330 MW Mead . . .

Australia’s offshore wind industry; from zephyr to gale

Published Date: 2023-January-12, Thursday

Almost two years ago AltEnergy issued a warning that

Australia was being left behind in the offshore wind stakes. With two more

international renewa . . .

Macquarie launches new big battery division, Eku Energy

Published Date: 2023-January-12, Thursday

Macquarie Group has launched a new global battery storage

platform, Eku Energy, which will have 190 MWh of flexible storage capacity under

construct . . .

Solar plans continue under Sev.en ownership

Published Date: 2023-January-10, Tuesday

Czech Republic-based investment group Sev.en Global

Investments’ expansion in Australia over the last month included acquisition of

the Vales Poin . . .

RES doubles its Australian asset management business

Published Date: 2022-November-8, Tuesday

RES just announced its acquisition of infrastructure asset management business Blueshore, which has 1.6 GW of assets under management, to more than do . . .

(002).jpg)