Another tool for big battery “Swiss army knives”

Published Date : 2024-April-30, Tuesday

No doubt about it, electricity transmission is a hot topic

in Australian energy circles at the moment. It’s abundantly clear that

Australia will need to invest in new transmission infrastructure to help

replace exiting coal-fired electricity, meet growing demand, and achieve our

Net Zero ambitions.

“There’s no transition without transmission” has become a

mantra echoed from as high up as the Energy Minister Chris Bowen.

In a recent speech CEO Daniel Westerman outlined energy

market regulator AEMO’s solution to Australia’s transmission needs as “10,000

kilometres of new transmission that urgently needs to be built”.

But while the NEM urgently needs all the electrons it can

get going into the grid to replace outgoing coal-fired power, solar and wind

farms are being curtailed due to transmission constraint issues. And

electricity prices continue to rise.

So are our policy-makers, planners and regulators casting a

wide enough net in their evaluation of potential responses to what has become

an urgent problem?

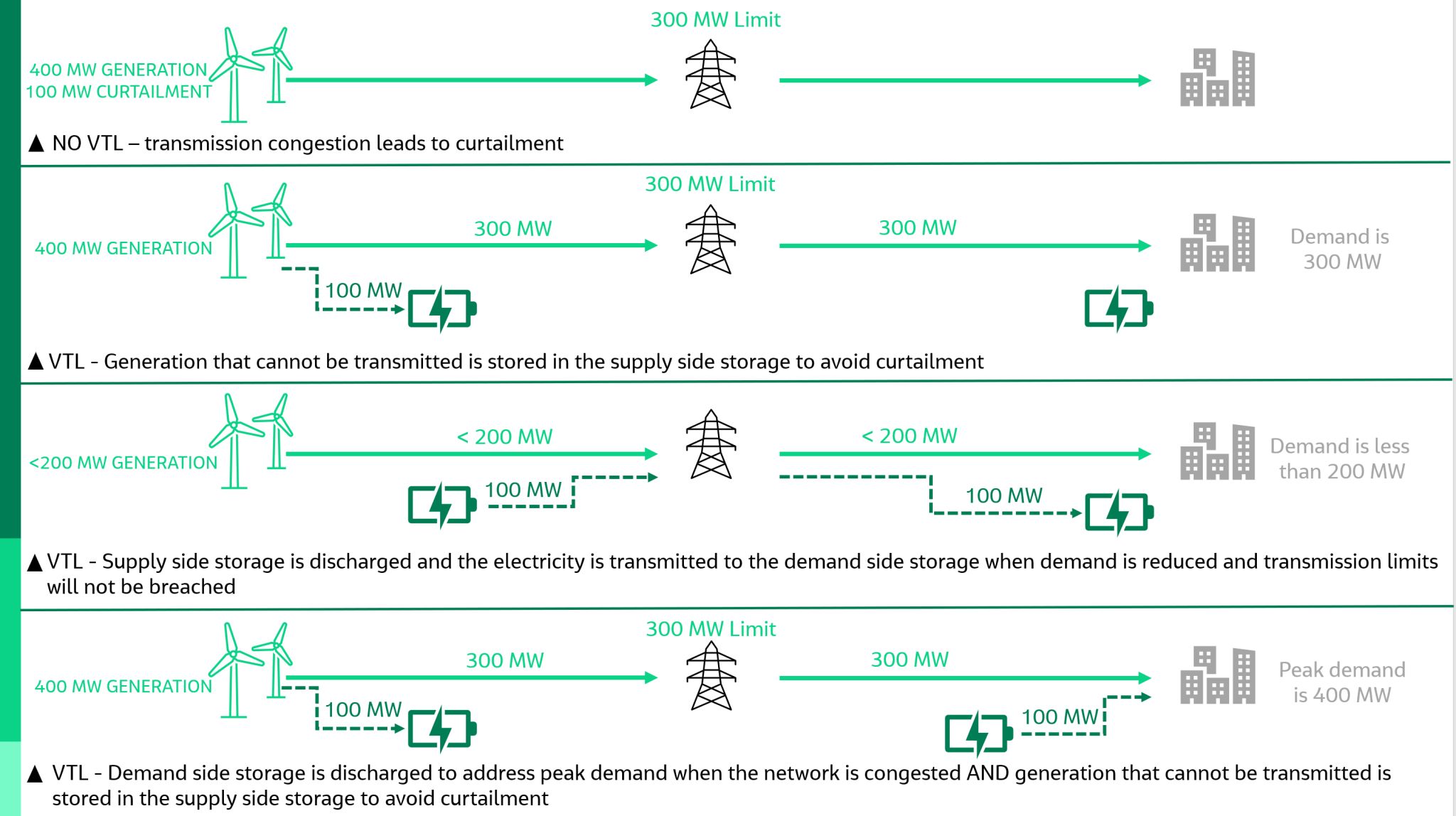

One potential solution, particularly in the shorter to

mid-term, appears to be struggling to get a look in; Virtual Transmission Lines

(VTLs) or Storage as a Transmission Asset (SATA).

How VTLs can work to alleviate network constraints was

clearly explained in a recent presentation by Jacobs Substations Technical

Director of Power in, Asia Pacific Lara Kruk.

According to Kruk, “Technically VTLs could be a clever way

of easing transmission congestion, which leads to generation curtailment, at

supply ends of the grid. At a minimum this could delay the need for some of the

thousands of kilometres of new transmission line that urgently needs to be

built leading to a more orderly process”.

AEMO has assessed VTLs, most notably as part of its Victoria

to New South Wales Interconnector West (VNI West) Regulatory Investment Test

for Transmission Project Assessment Draft Report released in July 2022.

The report found VTL “was not considered capable of forming

a credible standalone option” and didn’t stack up financially as an addition to

the proposed new high capacity 500 kilovolt double-circuit overhead

transmission line.

The scenario modelled more or less plonked the cost of two

new 250 MW batteries on top of the cost of the transmission line – which would

eventually need to be built anyway.

But what was not considered in detail by AEMO in the VNI

report were other non (directly) financial benefits VTL batteries can provide such

as obvious advantages in terms of planning and construction. A far simpler

process is involved in planning and building batteries compared with hundreds of

kilometres of new transmission line.

And in terms of personnel and supply chains, a lot more

equipment and a larger labour force is required to install thousands of

kilometres of transmission lines compared to installing several batteries.

“Australia will be competing for equipment and expertise

with other countries across the world which are also realising they need more

transmission infrastructure. In the short to mid-term VTLs could help spread

out these bottlenecks”, Kruk explained.

Policy-makers, regulators and TSNPs are also discovering

that some communities and landowners don’t share their enthusiasm for new transmission

lines. VTL batteries could alleviate the short to mid-term jam we are now in

which finds new renewable generation unable to join the grid at its maximum

capacity, allowing more time for community engagement and planning – let alone

construction - for the needed new transmission lines.

Batteries are being built at both the generation and demand

ends of the grid anyway, but these are primarily justified by accessing the

financial instruments involved in the FCAS and other ancillary service markets.

Technically these, and the hundreds more batteries planned

around the grid, could in part be deployed for VTL services, but developers

would need to have the regulatory framework and financial incentives to do so.

Maybe this is the more important point; that regulators and

policy-makers will need to dig into their full bags of tricks to try to ensure

a smooth energy transition, and the market settings are required to offer

incentives for developers to build the optimum solutions.

As noted by the Energy Grid Alliance, “Instead of

fast-tracking of new transmission links, regulators, law makers, government and

AEMO should be fast-tracking the reform that is necessary for a smoother, more

robust, and defensible transition”.

This should include a wide-ranging evaluation of the full

potential for VTLs to assist in the transition.