Is the BESS boom contributing to a wind and solar farm slowdown?

Published Date : 2023-November-8, Wednesday

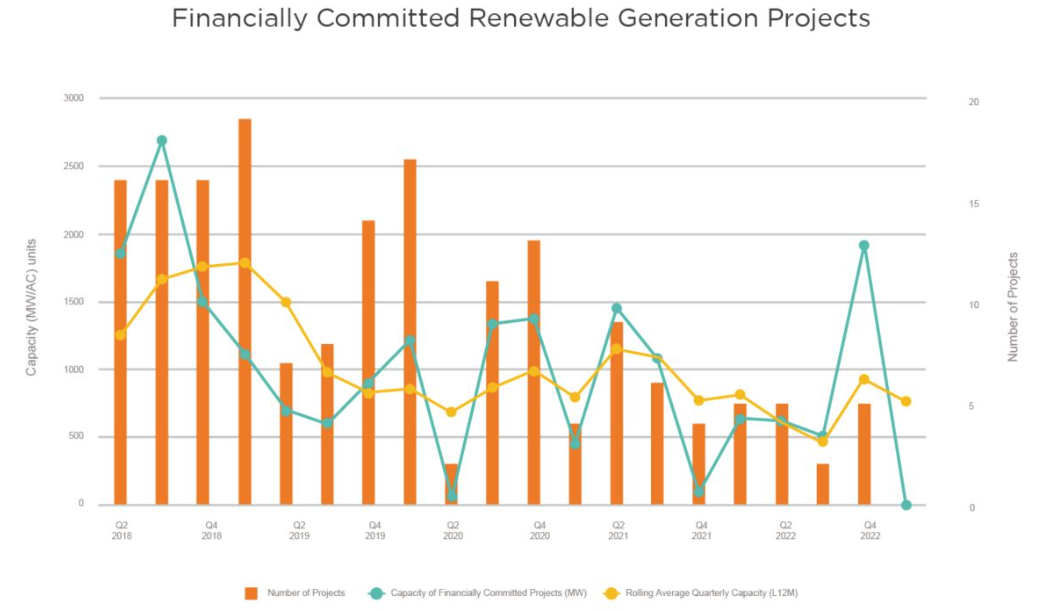

The Clean Energy Council (CEC) recently produced some

alarming statistics regarding the lack of investment in large-scale renewable

energy projects in the first quarter of this year.

As noted by the CEC, “No renewable generation projects

reached financial close in Q1 2023” indicating a worrying gap in construction

activity going forward. And the signs are Q2 will not be much better.

While there are a range of complex market factors that

combined to create this situation, there is potentially one contributing factor

that could correct itself soon.

And that contributing factor is highlighted by the one

project that did reach financial close in Q1. Eku Energy / Shell’s Rangebank

battery energy storage system (BESS) project in Melbourne’s south-east will provide

“200 MW of capacity and $400 million worth of new investment”, according to the

CEC.

The fact that a utility-scale BESS project was the only project

to reach FID in Q1 may reflect a wider current trend in the industry.

Data collected by AltEnergy shows resources continuing to pour

into BESS projects. Our database is tracking 143 BESS projects, and there is a

significant amount more directly attached to solar and wind farms where plans

are not sufficiently developed to split them out into a separate BESS project.

Of these 143 BESS projects, 86 were added since the

beginning of the year, and 41 in the last three months. There is a BESS boom

going on as developers scramble to pick the eyes out of the sweetest spots in

the NEM to install batteries.

Additionally, many of the larger wind and solar farm

developers in Australia are also developing BESS projects.

In the last few months companies such as Neoen, RES

Australia, RWE Renewables, Lightsource bp, Squadron Energy, ACEN Australia, Vena

Energy and Copenhagen Infrastructure Partners have added standalone or expanded

BESS projects to their portfolios.

These same companies are also behind many of Australia’s

largest wind and solar farm developments, and their resources – financial and personnel

– can only spread so far in a tight market.

Being relatively less complex to develop compared with large

wind and solar farms, we should see the number of BESS approvals and consequent

final investment decisions start to increase in the coming months.

Following that, more attention and resources should

gradually return back to wind and solar farm projects.

Let’s hope this will contribute to a reversal of the

slowdown in FIDs so far this year, which will prove to be a temporary blip in

the trend, and normal service will resume soon.